Today China decided to raise its lending and deposit rates. How could we interpret such a move?

In the near future we will draft a commentary on Icarus, but let us recall quickly his story. His father Daedalus prepared him wings to fly, warning him not to fly too close to the sun. In the beginning, Icarus was modest and he enjoyed the notoriety that others considered him a god. However, his arrogance led him to forget his father’s warnings. The modest flying got out of hand, he flew too close to the sun, his wings of wax melted and he came down.

Here is a multiple choice question:

China raised the interest rates because:

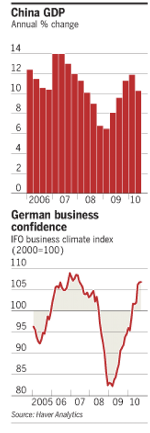

- There is impending inflation and they needed to slow down the prospects of overheating.

- They are under pressure to do something – prior to the G20 meetings – about their undervalued yuan, and avoid a currency war.

- China needs to demonstrate that the bipolarity (if not multipolarity) in economic affairs is back in the game, and thus it can move the markets along with the US.

- All of the above.

About six weeks ago we published in our September newsletter our thesis on China as a great wall of steroids, where a fundamental reversal has taken place (economic outcomes became goals that fed the different bubbles from real estate, to credit, to industrial, and infrastructure markets). In the last few weeks the Chinese have come under pressure to revalue their currency, and thus the global economy to start the process of correcting its imbalances. At the same time, China has been reasserting herself as a major player in global affairs. For all these reasons we believe that the answer to the above question is (d).

The Peoples Bank of China recently raised the reserve requirements in an effort to slow down credit. At the same time, funds have been flooding the Chinese markets (thus the Shanghai stock market gains in the last month) seeking higher returns, speculating on a Chinese currency appreciation, and feeding the spectacle of bubbles. The data that will soon be released may show an acceleration of Chinese inflation, a slowdown in EU’s growth prospects, and a reversal in confidence sentiment. A few days ago we wrote that Sisyphus (i.e. the US) needs to start rolling up the stone again. The Chinese interest rates increase advanced the dollar’s strength. It seems that Icarus is attempting a smooth landing before it’s too late. When was the last time we had a smooth landing?

The Peoples Bank of China recently raised the reserve requirements in an effort to slow down credit. At the same time, funds have been flooding the Chinese markets (thus the Shanghai stock market gains in the last month) seeking higher returns, speculating on a Chinese currency appreciation, and feeding the spectacle of bubbles. The data that will soon be released may show an acceleration of Chinese inflation, a slowdown in EU’s growth prospects, and a reversal in confidence sentiment. A few days ago we wrote that Sisyphus (i.e. the US) needs to start rolling up the stone again. The Chinese interest rates increase advanced the dollar’s strength. It seems that Icarus is attempting a smooth landing before it’s too late. When was the last time we had a smooth landing?

Multipolarity would be useful, but do not expect another Plaza Accord. Sage voices like Volcker may not be heard nowadays. Daedalus’ cries out to his son Icarus beware of the sun…

Brand Name Icarus: Lessons Learned?

Author : John E. Charalambakis

Date : October 19, 2010

Today China decided to raise its lending and deposit rates. How could we interpret such a move?

In the near future we will draft a commentary on Icarus, but let us recall quickly his story. His father Daedalus prepared him wings to fly, warning him not to fly too close to the sun. In the beginning, Icarus was modest and he enjoyed the notoriety that others considered him a god. However, his arrogance led him to forget his father’s warnings. The modest flying got out of hand, he flew too close to the sun, his wings of wax melted and he came down.

Here is a multiple choice question:

China raised the interest rates because:

About six weeks ago we published in our September newsletter our thesis on China as a great wall of steroids, where a fundamental reversal has taken place (economic outcomes became goals that fed the different bubbles from real estate, to credit, to industrial, and infrastructure markets). In the last few weeks the Chinese have come under pressure to revalue their currency, and thus the global economy to start the process of correcting its imbalances. At the same time, China has been reasserting herself as a major player in global affairs. For all these reasons we believe that the answer to the above question is (d).

Multipolarity would be useful, but do not expect another Plaza Accord. Sage voices like Volcker may not be heard nowadays. Daedalus’ cries out to his son Icarus beware of the sun…