Over the weekend the headline news was about the continuing turmoil in Arab countries. The reports state that over 200 people are dead in Libya, after the “firing on civilians” took place. The autocratic regime of Gaddafi may be cracking after more than 40 years in power. In Yemen and in Bahrain the regimes are also fearful of what might come next since their people have been in the streets asking for liberty, human rights, freedom, democracy, and opportunities for a better life.

Let us make no pretense. Those states have been endowed with natural resources. The regimes have enriched themselves, but the young people (over 60% of the population in the Middle East is less than 30 years old) feel marginalized and without decent opportunities for a better future.

The administration – unlike the French government which was caught sleeping at the wheel – deserves credit for how they have been handling the situation. These are painful days for political and economic maneuvering. The pain felt is birth pain. The New Silk Road will also pass through the Middle East, and this time around their destiny may not be derailed.

For the new to be born, the old needs to die, like the seed in the ground needs to die for the fruit to be born, or the cells in our bodies for life to be regenerated.

The petrostates of the Middle East have assets and the world needs credit. The critical mass has not been achieved yet for alternative fuels. What natural gas is to Russia (control of Europe’s energy brain) Middle East oil is to the world. The classic question “Cui Bono?” i.e. who benefits from these circumstances, may reveal the new emerging landscape. It will not be easy to persuade the autocrats and those who benefited from the oppressive regimes to give up power, benefits, and privileges. Instability will naturally evolve. This will feed fear, and uncertainty at a time when theocratic (not necessarily just theocratic but also oppressive) and other autocratic regimes envision to take advantage of the changing landscape. When the above pieces are added to the whole puzzle of fiscal and monetary uncertainties and crises, the picture becomes even more complex.

The fiscal and budgetary battles in the US, the EU’s fiscal crisis, the foreseeable end of monetary easing, the rising food prices, the interbank market that remains unsettled, the credit risks, the toxic as well as the level 3 assets that are still in balance sheets, and what we have been calling the Chinese case, mixes up a pretty unhealthy cocktail of potential economic and political disequilibrium.

The graphs below show the prices for oil (West Texas Intermediaries, and North Sea Brent).

| WTI Price |

North Sea Brent |

|

|

What we could observe is that the WTI has experienced an 8.5% drop since late January, while the Brent variety has gained about 5%. The intricacies and dynamics of the oil market make us think that in the environment we described above oil has a lot to gain in the months ahead. Of course, it fits well into our philosophy of real, hard and tangible assets that serve both productive and collateral purposes.

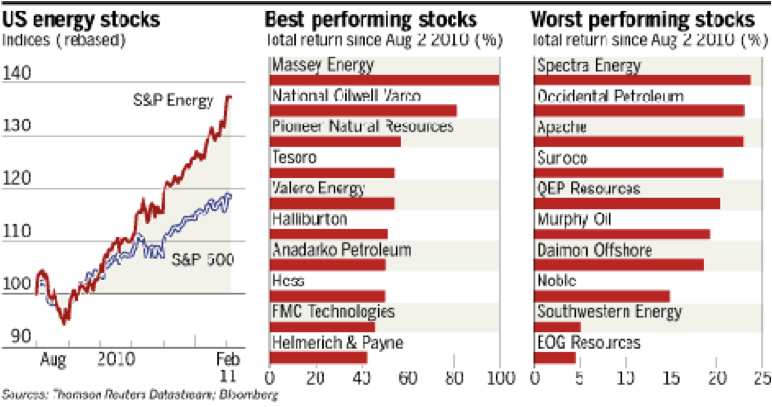

Oil prices in general have not kept up with the increases that other commodities have experienced. Thus, while the next graph shows us that it has outperformed the S&P 500, based on calculations made relating the historical co-movement of oil and other commodities, we believe that oil has room to gain, especially under the current circumstances.

Hence the current WTI price retreat, it may resemble the gold and silver retreats that were observed in the month of January, where they found their support level, consolidated their positions, and started taking their proper place in the new lineup.

We only hope the new lineup will have anchors and exits so that derailments will not be too often.

Ode then to competent anchors that enable exits!

Birth Pains: Petrostates, Oil Prices, and the Emerging Middle East Landscape

Author : John E. Charalambakis

Date : February 21, 2011

Over the weekend the headline news was about the continuing turmoil in Arab countries. The reports state that over 200 people are dead in Libya, after the “firing on civilians” took place. The autocratic regime of Gaddafi may be cracking after more than 40 years in power. In Yemen and in Bahrain the regimes are also fearful of what might come next since their people have been in the streets asking for liberty, human rights, freedom, democracy, and opportunities for a better life.

Let us make no pretense. Those states have been endowed with natural resources. The regimes have enriched themselves, but the young people (over 60% of the population in the Middle East is less than 30 years old) feel marginalized and without decent opportunities for a better future.

The administration – unlike the French government which was caught sleeping at the wheel – deserves credit for how they have been handling the situation. These are painful days for political and economic maneuvering. The pain felt is birth pain. The New Silk Road will also pass through the Middle East, and this time around their destiny may not be derailed.

For the new to be born, the old needs to die, like the seed in the ground needs to die for the fruit to be born, or the cells in our bodies for life to be regenerated.

The petrostates of the Middle East have assets and the world needs credit. The critical mass has not been achieved yet for alternative fuels. What natural gas is to Russia (control of Europe’s energy brain) Middle East oil is to the world. The classic question “Cui Bono?” i.e. who benefits from these circumstances, may reveal the new emerging landscape. It will not be easy to persuade the autocrats and those who benefited from the oppressive regimes to give up power, benefits, and privileges. Instability will naturally evolve. This will feed fear, and uncertainty at a time when theocratic (not necessarily just theocratic but also oppressive) and other autocratic regimes envision to take advantage of the changing landscape. When the above pieces are added to the whole puzzle of fiscal and monetary uncertainties and crises, the picture becomes even more complex.

The fiscal and budgetary battles in the US, the EU’s fiscal crisis, the foreseeable end of monetary easing, the rising food prices, the interbank market that remains unsettled, the credit risks, the toxic as well as the level 3 assets that are still in balance sheets, and what we have been calling the Chinese case, mixes up a pretty unhealthy cocktail of potential economic and political disequilibrium.

The graphs below show the prices for oil (West Texas Intermediaries, and North Sea Brent).

What we could observe is that the WTI has experienced an 8.5% drop since late January, while the Brent variety has gained about 5%. The intricacies and dynamics of the oil market make us think that in the environment we described above oil has a lot to gain in the months ahead. Of course, it fits well into our philosophy of real, hard and tangible assets that serve both productive and collateral purposes.

Oil prices in general have not kept up with the increases that other commodities have experienced. Thus, while the next graph shows us that it has outperformed the S&P 500, based on calculations made relating the historical co-movement of oil and other commodities, we believe that oil has room to gain, especially under the current circumstances.

Hence the current WTI price retreat, it may resemble the gold and silver retreats that were observed in the month of January, where they found their support level, consolidated their positions, and started taking their proper place in the new lineup.

We only hope the new lineup will have anchors and exits so that derailments will not be too often.

Ode then to competent anchors that enable exits!