The macroeconomic picture – globally – does not look that promising. Trends need to be reversed in order to avoid the dawn of the waste land. However, for the near term measures taken have the effect of addressing some symptoms and provide short-term relief and hope. From that perspective and as we wrote in previous commentaries, we anticipate the markets in the current year to exhibit positive returns.

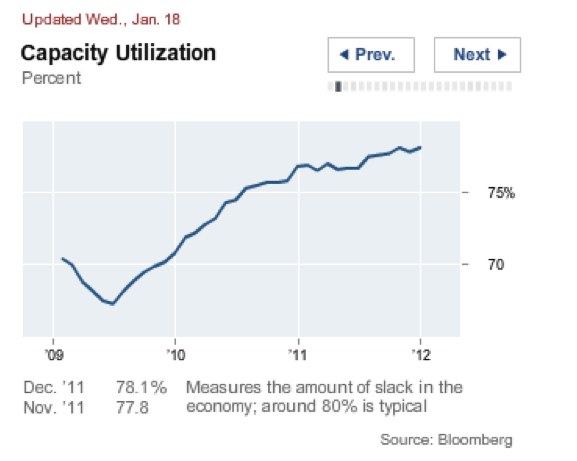

Here are some facts that make us draw those expectations. As a number of graphs shown below demonstrate, all evidence points to the direction that the recovery is strengthening. Let’s start with one of the most important indicators, that of capacity utilization. The graph below shows that it keeps rising, and is approaching the critical level of 80. If the trend continues, then incomes will rise, confidence will do the same, spending will increase, and growth will pick up pace reducing the unemployment rate.

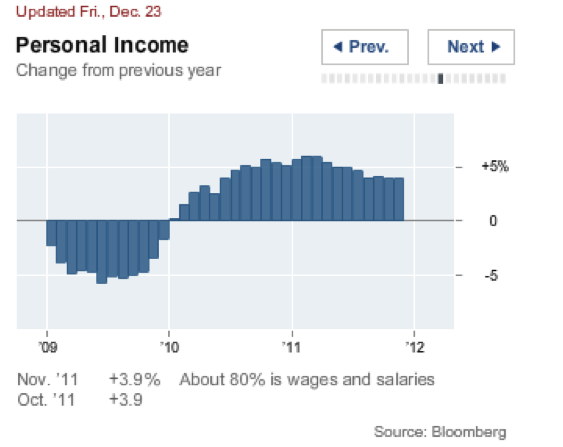

Actually, as the following graph shows, the sequence described above seems already to be underway, with incomes rising at a steady pace close to 4%. If that continues, it will become a cornerstone for higher growth in the GDP.

The sustained growth in personal incomes is significant for consumer confidence, which as the graph below demonstrates has started reversing its downward trend.

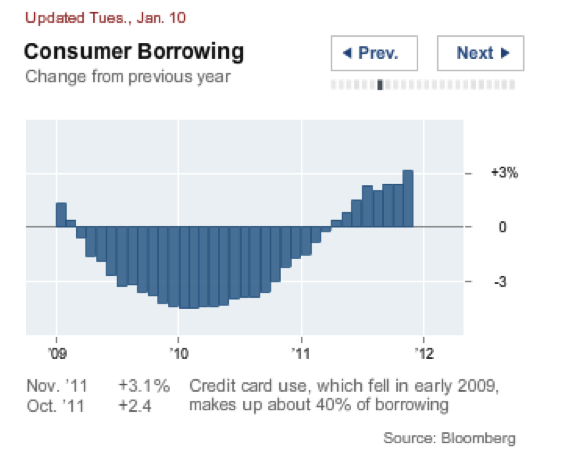

This reversal is fundamental for willingness to borrow and also important if we desire to reverse the deleveraging process (even if we believe that this is one of the most difficult things to be accomplished in the near term).

However, it seems that slowly that reversal in borrowing is taking place, which should boost production and manufacturing activity. Let’s not forget that the prosperity of a nation does not depend on its ability to consume but rather on its ability to produce.

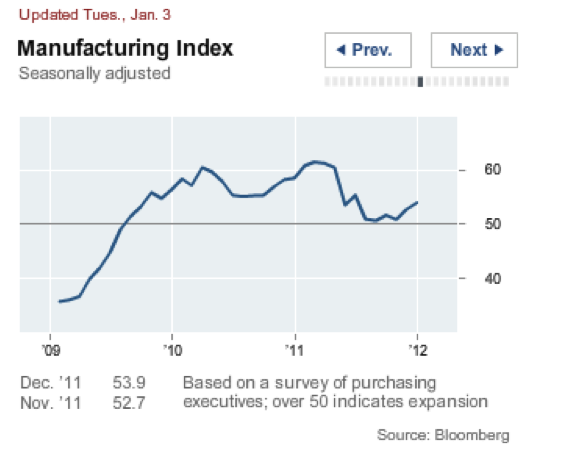

Having a manufacturing index above 50, is important for keeping the inventories at levels that will require additional production.

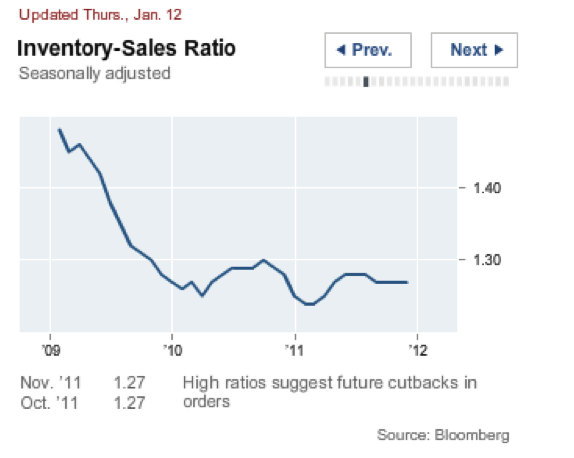

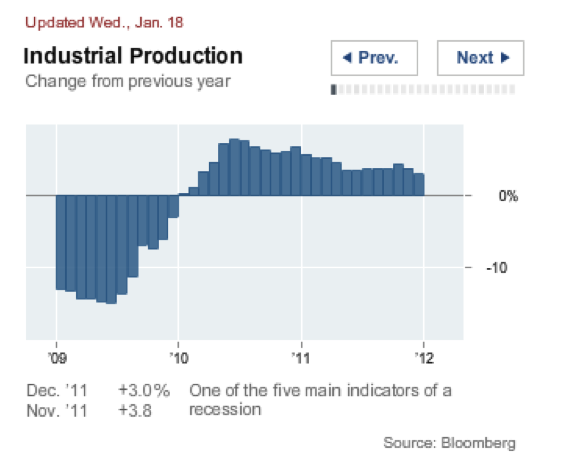

The ratio above shows that we are experiencing a healthy decline in the inventory-to-sales ratio, which points to more orders, and higher production activity something that the following two graphs demonstrate.

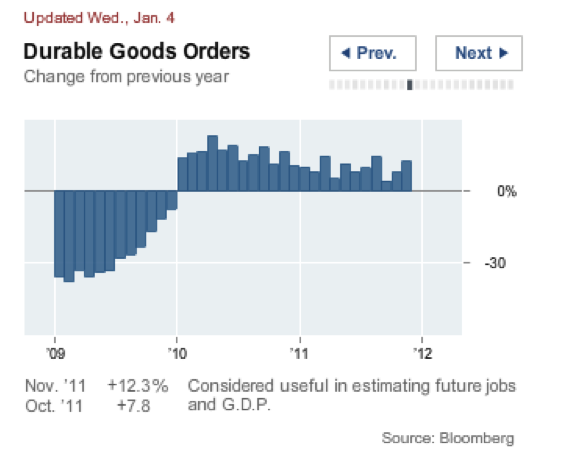

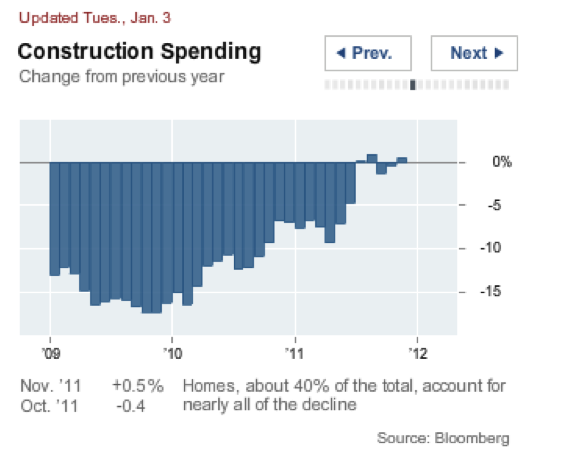

Since orders keep increasing and having a commitment for historically low interest rates, we anticipate that housing reversal will take place, and construction spending will start picking up pace.

The reversal in construction spending along with more bank borrowing will enhance returns in the real estate sector which temporarily will boost growth.

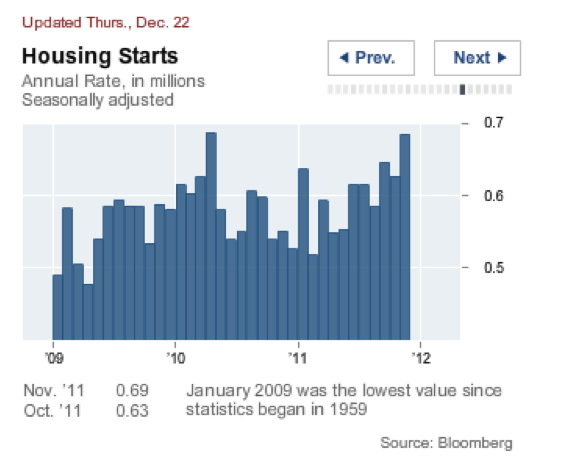

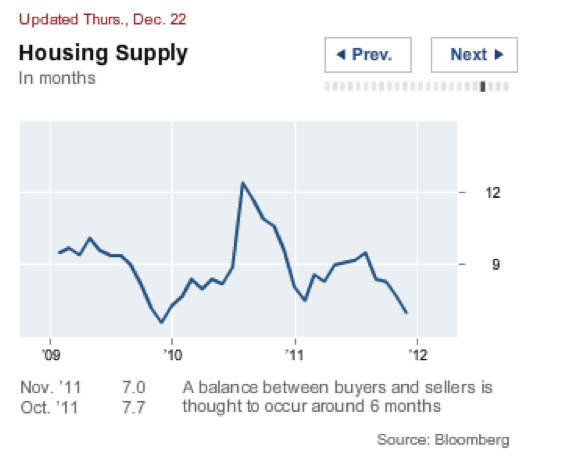

We believe that housing starts not only have they been stabilized but an upward trend may be seen before the year’s end, given the declining supply of existing housing, as the figure below shows.

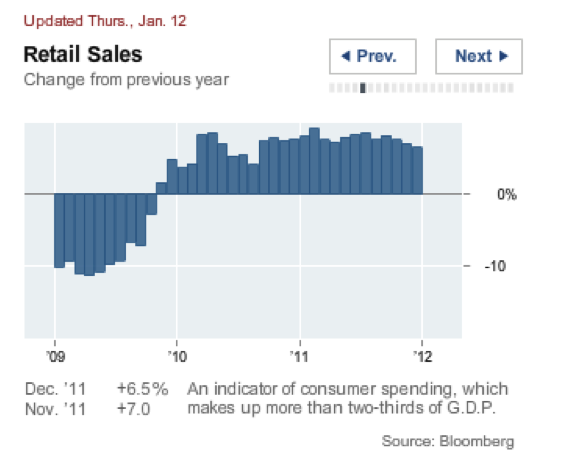

To all the figures above, we should add the stable growth in retail sales, all of which lead to the reduction in the unemployment rate.

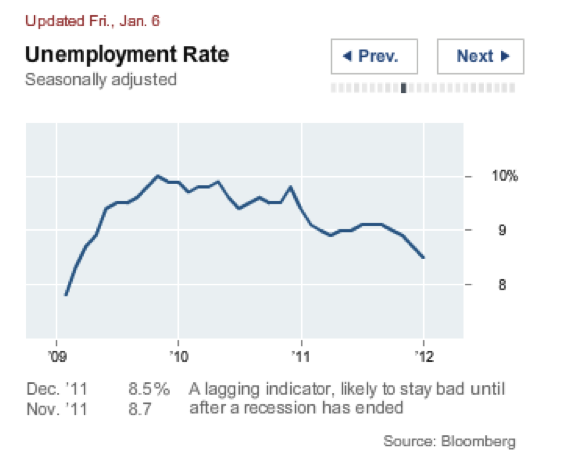

The current unemployment rate of 8.5% most probably will continue its downward trend, something that will reinforce a feedback loop mechanism.

It seems that finally – with a time lag that should have been expected – fiscal and monetary measures have been having a positive effect on the economy, however, as we said in the beginning we have been treating symptoms and not the causes of credit overextension based on the securitization of otherwise uncollateralized paper assets.

It seems to us that we are eating our own flesh by squandering away balance sheets, misallocating capital, and shooting ourselves in the foot through a process that destroys rather than creates wealth. Wealth creation requires capital formation. Nowadays, we have settled for a reality that creates “wealth” through paper and accounting manipulations. Cost cutting does not form capital. Financial engineering does advance productivity and job creation. Bond trading and derivatives’ algorithmization does not contribute to innovation that is necessary for factor inputs. We “save” but we are on the wrong side of the savings efficiency frontier since we are consuming rather than producing factors of production. We are borrowing from the Chinese, but they in turn copy rather than innovate, hence global total factor productivity keeps declining. The printing machine of central banks has been assaulted by destructive creation of credit that distorts prices (e.g. in housing) and in the process it expropriates capital from the real economy. The declining – worldwide – marginal productivity of capital, along with the declining R&D, impose a high toll on the economies.

If these trends continue, the global economy will not be able to sustain jobs, incomes, and the current standard of living. Generational accounting teaches us that the longevity we desire is unfunded given the dismal level of savings we have. At the root-cause of the problems we see a society that has lost it’s capacity to think rationally. It seems that the educational system has failed the people who like to be mesmerized by reality vocation that trains rather than educates them.

Therefore, while we believe that in the short-term things may look better, the extrapolation of fundamental trends shows us that we are facing the dawn of the waste land. Let’s hope for an awakening.

Ode to awakenings!

Before the Dawn of the Waste Land: Expected Returns, and Economic Performance

Author : John E. Charalambakis

Date : January 18, 2012

The macroeconomic picture – globally – does not look that promising. Trends need to be reversed in order to avoid the dawn of the waste land. However, for the near term measures taken have the effect of addressing some symptoms and provide short-term relief and hope. From that perspective and as we wrote in previous commentaries, we anticipate the markets in the current year to exhibit positive returns.

Here are some facts that make us draw those expectations. As a number of graphs shown below demonstrate, all evidence points to the direction that the recovery is strengthening. Let’s start with one of the most important indicators, that of capacity utilization. The graph below shows that it keeps rising, and is approaching the critical level of 80. If the trend continues, then incomes will rise, confidence will do the same, spending will increase, and growth will pick up pace reducing the unemployment rate.

Actually, as the following graph shows, the sequence described above seems already to be underway, with incomes rising at a steady pace close to 4%. If that continues, it will become a cornerstone for higher growth in the GDP.

The sustained growth in personal incomes is significant for consumer confidence, which as the graph below demonstrates has started reversing its downward trend.

This reversal is fundamental for willingness to borrow and also important if we desire to reverse the deleveraging process (even if we believe that this is one of the most difficult things to be accomplished in the near term).

However, it seems that slowly that reversal in borrowing is taking place, which should boost production and manufacturing activity. Let’s not forget that the prosperity of a nation does not depend on its ability to consume but rather on its ability to produce.

Having a manufacturing index above 50, is important for keeping the inventories at levels that will require additional production.

The ratio above shows that we are experiencing a healthy decline in the inventory-to-sales ratio, which points to more orders, and higher production activity something that the following two graphs demonstrate.

Since orders keep increasing and having a commitment for historically low interest rates, we anticipate that housing reversal will take place, and construction spending will start picking up pace.

The reversal in construction spending along with more bank borrowing will enhance returns in the real estate sector which temporarily will boost growth.

We believe that housing starts not only have they been stabilized but an upward trend may be seen before the year’s end, given the declining supply of existing housing, as the figure below shows.

To all the figures above, we should add the stable growth in retail sales, all of which lead to the reduction in the unemployment rate.

The current unemployment rate of 8.5% most probably will continue its downward trend, something that will reinforce a feedback loop mechanism.

It seems that finally – with a time lag that should have been expected – fiscal and monetary measures have been having a positive effect on the economy, however, as we said in the beginning we have been treating symptoms and not the causes of credit overextension based on the securitization of otherwise uncollateralized paper assets.

It seems to us that we are eating our own flesh by squandering away balance sheets, misallocating capital, and shooting ourselves in the foot through a process that destroys rather than creates wealth. Wealth creation requires capital formation. Nowadays, we have settled for a reality that creates “wealth” through paper and accounting manipulations. Cost cutting does not form capital. Financial engineering does advance productivity and job creation. Bond trading and derivatives’ algorithmization does not contribute to innovation that is necessary for factor inputs. We “save” but we are on the wrong side of the savings efficiency frontier since we are consuming rather than producing factors of production. We are borrowing from the Chinese, but they in turn copy rather than innovate, hence global total factor productivity keeps declining. The printing machine of central banks has been assaulted by destructive creation of credit that distorts prices (e.g. in housing) and in the process it expropriates capital from the real economy. The declining – worldwide – marginal productivity of capital, along with the declining R&D, impose a high toll on the economies.

If these trends continue, the global economy will not be able to sustain jobs, incomes, and the current standard of living. Generational accounting teaches us that the longevity we desire is unfunded given the dismal level of savings we have. At the root-cause of the problems we see a society that has lost it’s capacity to think rationally. It seems that the educational system has failed the people who like to be mesmerized by reality vocation that trains rather than educates them.

Therefore, while we believe that in the short-term things may look better, the extrapolation of fundamental trends shows us that we are facing the dawn of the waste land. Let’s hope for an awakening.

Ode to awakenings!