Richard Koo has been known as the father of the “balance sheet recession” theory. The essence of his theory states that monetary policy becomes ineffective when interest rates drop to almost zero, and thus government spending (fiscal policy) can only rebalance the economy. One of the problems with this theory is the fact that government spending is also a culprit in the crisis we recently experienced and the incomprehensible unfunded liabilities that we are facing may soon bring us to the reality described by Stephen D. King in his book When Money Runs Out.

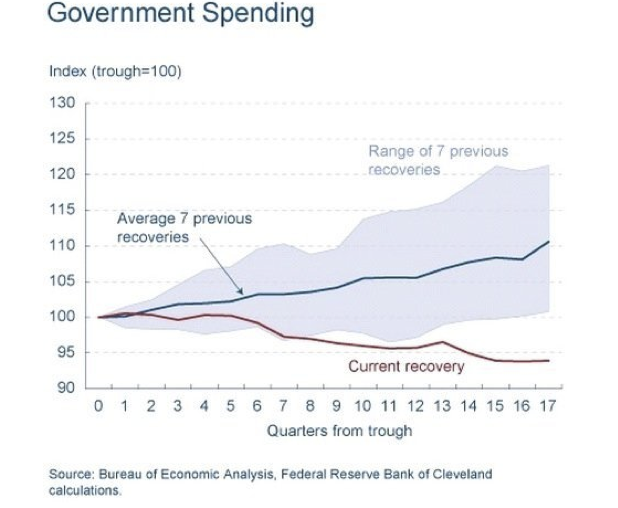

In previous recessions, governments tried to fight the downturn by spending money they did not have. In the past, and as the graph below shows for about seventeen quarters after the trough of the recession, government spending in the US kept rising. However, the current economic and political reality dictated a different approach. Under the current circumstances, government spending followed a totally different trajectory than the previous experiences dictated.

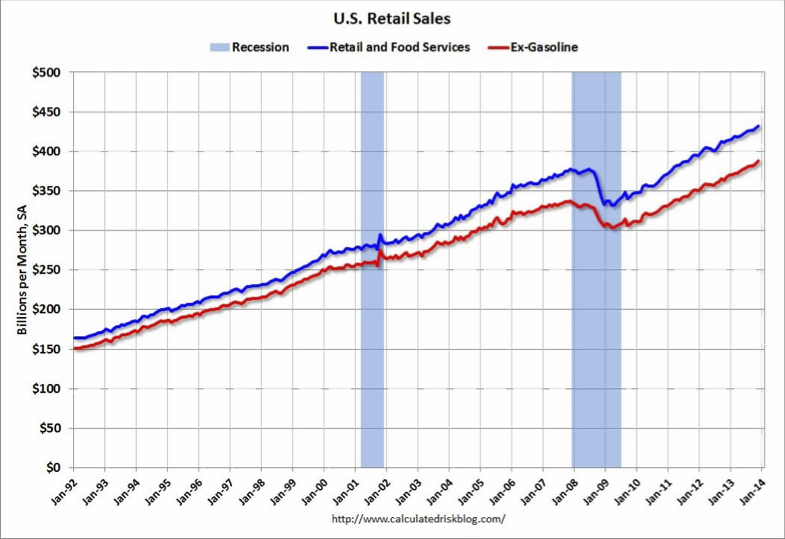

It is very normal for the private sector (businesses and households) to deleverage during crisis time. Moreover, we knew that given the extent and the causes of the crisis which made us reach the edge of the abyss, the time required to return to normalcy would be significant longer than average. The good news is that households feel more confident nowadays and their spending is rising, as the latest figure below shows.

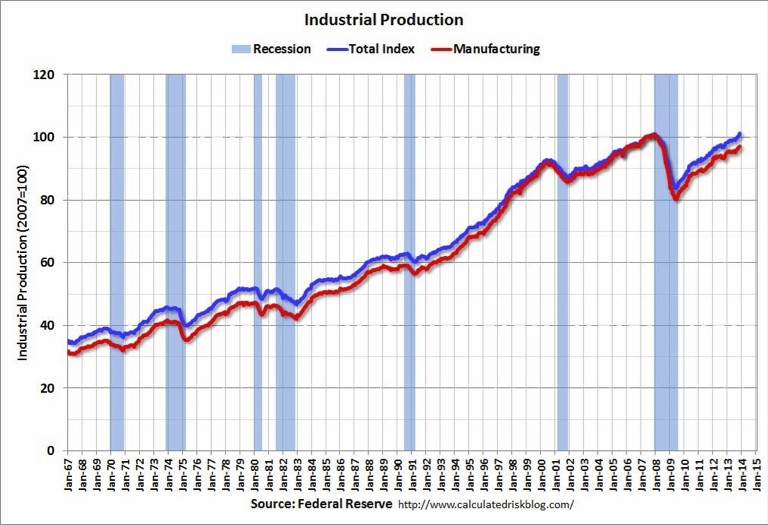

It is not though just retail sales that are rising. Industrial production increases too at a steady pace. As the graph below portrays, manufacturing follows a steady upward trend. This is one of the major reasons that made me claim in recent commentaries that in 2014 we will most probably witness a turnaround in business investment, which will be translated into higher capital expenditures and greater global trade levels.

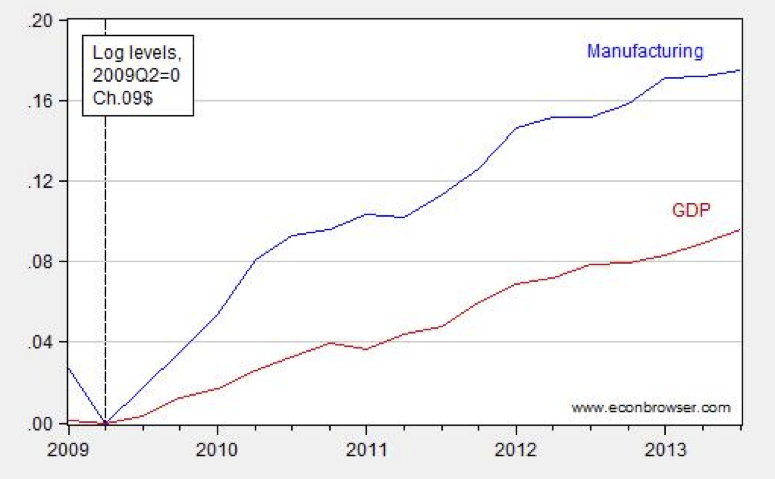

Actually, manufacturing has grown 8.8% more rapidly than the GDP (as of the third quarter of 2013), as the graph below shows.

As the economy expands so do our exports and the latest data confirm that exports as a fraction of GDP keep rising. I expect global trade to expand significantly in the next two years, and thus the shipping sector is expected to perform relative stronger than others.

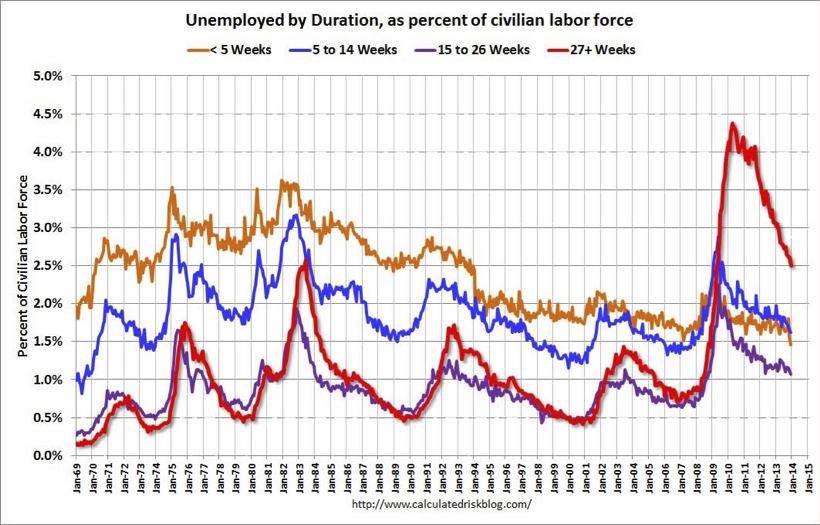

As businesses and households increase their activities, employment numbers will keep improving. Therefore, and despite the fact that the latest employment numbers released last Friday were below expectations (with the exception of the unemployment rate that dropped to the level that the Fed targeted i.e.6.7%, at least for now), the more encouraging news can be found in the duration of unemployment. As the graph below clearly shows the downward trend became stronger for all categories and the “6-14 weeks” is close to the normal level. The fact that we observe a dramatic decline in the long-term trend might be due to the fact that some workers are dropping out, however we cannot deny the fact that at 2.5% of the labor force the long-term unemployment rate is at the lowest level since 2009, which is very good news.

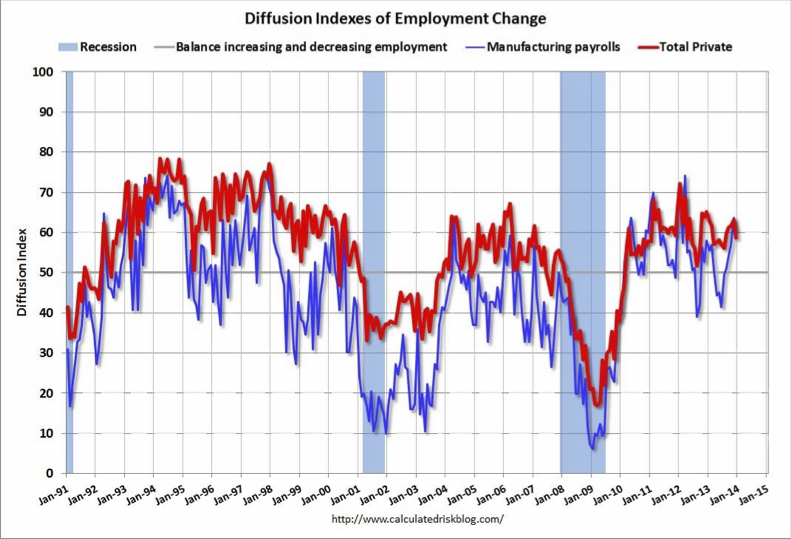

The fact that job gains have taken a stronghold could be verified through the diffusion index. The farther from 50 the diffusion index is (relative to a year earlier) the stronger the gains are and the better the prospects are, because it signifies that more industries are increasing employment than those which are decreasing it. As we can see in the latest index below the diffusion index remains well above 50 and relative to a year ago it stands stronger.

The underlying rebalancing acts that we are observing need to be accompanied by a structural shift in finance. Specifically, the unsustainable debt levels around the world require radical changes whose pre-requisite is the awakening of dormant assets. I am cautiously optimistic that some changes are taking place in that direction. My hope is that the pace of those changes will increase before time runs out.

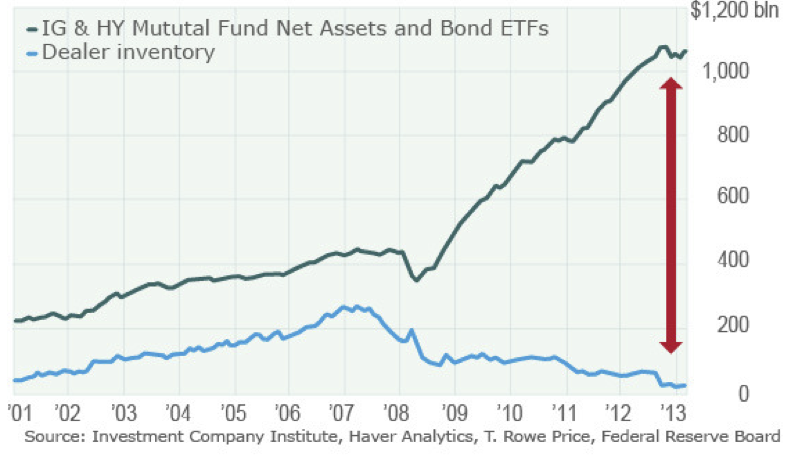

However, awaking dormant assets which can be collateralized for credit and wealth creation purposes requires also a dramatic change in the way that bonds are traded, given that they represent liabilities rather than pure assets. I am optimistic that we may be on the right course in that area too. The data on bond trading show that while the total amount of trades in the high-grade corporate bond market has been rising, trades sizes have been shrinking, which in turn portrays that those trades accommodate smaller balance sheets. This change gives smaller firms an advantage on Wall Street. As the graph below shows the size of the bond market may be growing but dealers’ balance sheet is shrinking.

In closing, I would reiterate my market optimism for the current calendar year and I will add my kudos to the underlying rebalancing acts.

Ode to changes that are destined in awaking dormant assets!

Balance Sheet Recession Reconsidered: Rebalancing Acts at a Time of Crisis

Author : John E. Charalambakis

Date : January 13, 2014

Richard Koo has been known as the father of the “balance sheet recession” theory. The essence of his theory states that monetary policy becomes ineffective when interest rates drop to almost zero, and thus government spending (fiscal policy) can only rebalance the economy. One of the problems with this theory is the fact that government spending is also a culprit in the crisis we recently experienced and the incomprehensible unfunded liabilities that we are facing may soon bring us to the reality described by Stephen D. King in his book When Money Runs Out.

In previous recessions, governments tried to fight the downturn by spending money they did not have. In the past, and as the graph below shows for about seventeen quarters after the trough of the recession, government spending in the US kept rising. However, the current economic and political reality dictated a different approach. Under the current circumstances, government spending followed a totally different trajectory than the previous experiences dictated.

It is very normal for the private sector (businesses and households) to deleverage during crisis time. Moreover, we knew that given the extent and the causes of the crisis which made us reach the edge of the abyss, the time required to return to normalcy would be significant longer than average. The good news is that households feel more confident nowadays and their spending is rising, as the latest figure below shows.

It is not though just retail sales that are rising. Industrial production increases too at a steady pace. As the graph below portrays, manufacturing follows a steady upward trend. This is one of the major reasons that made me claim in recent commentaries that in 2014 we will most probably witness a turnaround in business investment, which will be translated into higher capital expenditures and greater global trade levels.

Actually, manufacturing has grown 8.8% more rapidly than the GDP (as of the third quarter of 2013), as the graph below shows.

As the economy expands so do our exports and the latest data confirm that exports as a fraction of GDP keep rising. I expect global trade to expand significantly in the next two years, and thus the shipping sector is expected to perform relative stronger than others.

As businesses and households increase their activities, employment numbers will keep improving. Therefore, and despite the fact that the latest employment numbers released last Friday were below expectations (with the exception of the unemployment rate that dropped to the level that the Fed targeted i.e.6.7%, at least for now), the more encouraging news can be found in the duration of unemployment. As the graph below clearly shows the downward trend became stronger for all categories and the “6-14 weeks” is close to the normal level. The fact that we observe a dramatic decline in the long-term trend might be due to the fact that some workers are dropping out, however we cannot deny the fact that at 2.5% of the labor force the long-term unemployment rate is at the lowest level since 2009, which is very good news.

The fact that job gains have taken a stronghold could be verified through the diffusion index. The farther from 50 the diffusion index is (relative to a year earlier) the stronger the gains are and the better the prospects are, because it signifies that more industries are increasing employment than those which are decreasing it. As we can see in the latest index below the diffusion index remains well above 50 and relative to a year ago it stands stronger.

The underlying rebalancing acts that we are observing need to be accompanied by a structural shift in finance. Specifically, the unsustainable debt levels around the world require radical changes whose pre-requisite is the awakening of dormant assets. I am cautiously optimistic that some changes are taking place in that direction. My hope is that the pace of those changes will increase before time runs out.

However, awaking dormant assets which can be collateralized for credit and wealth creation purposes requires also a dramatic change in the way that bonds are traded, given that they represent liabilities rather than pure assets. I am optimistic that we may be on the right course in that area too. The data on bond trading show that while the total amount of trades in the high-grade corporate bond market has been rising, trades sizes have been shrinking, which in turn portrays that those trades accommodate smaller balance sheets. This change gives smaller firms an advantage on Wall Street. As the graph below shows the size of the bond market may be growing but dealers’ balance sheet is shrinking.

In closing, I would reiterate my market optimism for the current calendar year and I will add my kudos to the underlying rebalancing acts.

Ode to changes that are destined in awaking dormant assets!