This coming Friday, July 23, 2010, the EU will make public the results of the stress tests implemented on its banks. Three comments are in order prior to the release: First, will analysts be able to reproduce the results especially for weak banks (assuming that the latter will be allowed to participate in the tests at all)? If not, then the credibility of the results will be in question. Second, what are the benchmarks? What are the assumptions/scenarios of the tests? And, what criteria were employed to truly count something as an asset in the banks’ balance sheets? Ambiguity as to what counts as an asset, as well as whether the worst possible scenarios have been contemplated in the tests, will water down the credibility of the results. Third, if the results demonstrate – as expected ? that some banks (including some well?known names) are not well capitalized, then will the newly structured rescue package of close to one trillion US dollars be allowed to be used to rescue those banks?

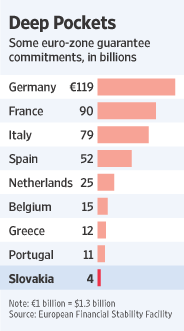

It seems to us that this is exactly what will take place. Mr. Klauss Regling, who was appointed as the head of the Luxemburg?based European Financial Stability Facility (EFSF), is certain that the bonds that the EFSF will issue will receive AAA rating, and via their sale, the funds will be raised at very low rates for the recipients. This may postpone the problems and the upcoming crisis by kicking the can of worms down the road. However, clouds are gathering due to delevaraging, excess capacity, high unemployment, lack of growth, and a mass of debt instruments whose quality is at best questionable and at worst worthless. The following figure shows the fund that is being built based on government guarantees. (i.e. without hard collateral assets)

We have previously published (see our commentary on July 1, 2010) that the securitization market is pretty much frozen both in the EU and the US. The two main western central banks (ECB, and the Fed) have been the buyers of last resort of seasoned or freshly cut paper. Healthy banks hesitate to lend to other banks for the fear of the counter?party balance sheet risk. Central banks buy the paper to inject liquidity, therefore there is plethora of monetary aggregates. However, the latter does not flow into the anorexic public (thus the decreasing money supply, as we have shown before) for the fear of default, let alone of another crisis. Thus, the only market that functions is the government bond market (primarily the US one) which lowers yields, enables government debt refinancing, while instilling a sense of false security by keeping cash or cash equivalents in the different portfolios.

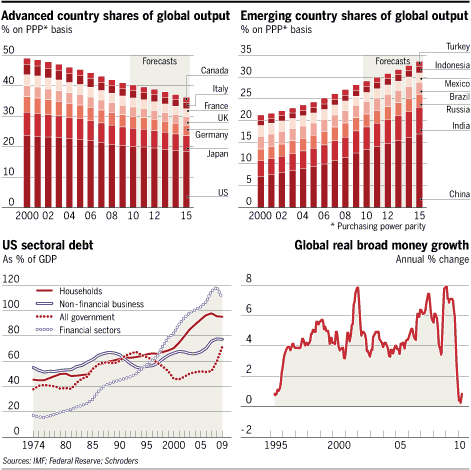

Inevitably then, the combination of all of the above as well as of the other things we have written before, lead to declining prices, and the threat of deflation. The latter, will reduce profits, wages, demand, employment and of course the equities markets with the ultimate result of having the false sense that we are on top of a penthouse while the foundations are cracking. The next figure portrays that the declining money supply – for reasons explained in other commentaries – in association with rising debt levels and the declining role of the western nations, make a lethal cocktail, that unless it is addressed within the next 6?10 months, the 2007?’09 experience may prove to be the prelude to a devastating crisis.

Therefore, we are of the opinion that while in the next two quarters the financial markets may send signals of life due to camouflage maneuvers such as the EFSF and the infusion of cash to the banking sector via the EU and other rescue packages, in the medium?to?long term these maneuvers will exacerbate the problems, will accelerate the deleveraging cycle, will worsen the true unemployment figures, and will further diminish liquidity leading to a disorderly reduction in credit, continuation of capital flight, and a misallocation of capital that will be reinforced by the distortion of the banks as intermediaries and the destruction of productive capacity.

The above discussion, points to the possibility that while the impulses of the banks, the private sector, and of governments is to tighten the belts, such moves while reflecting prudence and virtue on the surface, could well contain seeds of self?destruction where deficits grow, unemployment remains stubbornly high, growth stagnates, and disarray prevails where investors will be looking for the safest of assets (hopefully not in paper).

The ride continues with exciting routes!

Awaiting the EU Banking Stress Tests: Plethora of Food and the Anorexic Sector

Author : John E. Charalambakis

Date : July 22, 2010

This coming Friday, July 23, 2010, the EU will make public the results of the stress tests implemented on its banks. Three comments are in order prior to the release: First, will analysts be able to reproduce the results especially for weak banks (assuming that the latter will be allowed to participate in the tests at all)? If not, then the credibility of the results will be in question. Second, what are the benchmarks? What are the assumptions/scenarios of the tests? And, what criteria were employed to truly count something as an asset in the banks’ balance sheets? Ambiguity as to what counts as an asset, as well as whether the worst possible scenarios have been contemplated in the tests, will water down the credibility of the results. Third, if the results demonstrate – as expected ? that some banks (including some well?known names) are not well capitalized, then will the newly structured rescue package of close to one trillion US dollars be allowed to be used to rescue those banks?

It seems to us that this is exactly what will take place. Mr. Klauss Regling, who was appointed as the head of the Luxemburg?based European Financial Stability Facility (EFSF), is certain that the bonds that the EFSF will issue will receive AAA rating, and via their sale, the funds will be raised at very low rates for the recipients. This may postpone the problems and the upcoming crisis by kicking the can of worms down the road. However, clouds are gathering due to delevaraging, excess capacity, high unemployment, lack of growth, and a mass of debt instruments whose quality is at best questionable and at worst worthless. The following figure shows the fund that is being built based on government guarantees. (i.e. without hard collateral assets)

We have previously published (see our commentary on July 1, 2010) that the securitization market is pretty much frozen both in the EU and the US. The two main western central banks (ECB, and the Fed) have been the buyers of last resort of seasoned or freshly cut paper. Healthy banks hesitate to lend to other banks for the fear of the counter?party balance sheet risk. Central banks buy the paper to inject liquidity, therefore there is plethora of monetary aggregates. However, the latter does not flow into the anorexic public (thus the decreasing money supply, as we have shown before) for the fear of default, let alone of another crisis. Thus, the only market that functions is the government bond market (primarily the US one) which lowers yields, enables government debt refinancing, while instilling a sense of false security by keeping cash or cash equivalents in the different portfolios.

Inevitably then, the combination of all of the above as well as of the other things we have written before, lead to declining prices, and the threat of deflation. The latter, will reduce profits, wages, demand, employment and of course the equities markets with the ultimate result of having the false sense that we are on top of a penthouse while the foundations are cracking. The next figure portrays that the declining money supply – for reasons explained in other commentaries – in association with rising debt levels and the declining role of the western nations, make a lethal cocktail, that unless it is addressed within the next 6?10 months, the 2007?’09 experience may prove to be the prelude to a devastating crisis.

Therefore, we are of the opinion that while in the next two quarters the financial markets may send signals of life due to camouflage maneuvers such as the EFSF and the infusion of cash to the banking sector via the EU and other rescue packages, in the medium?to?long term these maneuvers will exacerbate the problems, will accelerate the deleveraging cycle, will worsen the true unemployment figures, and will further diminish liquidity leading to a disorderly reduction in credit, continuation of capital flight, and a misallocation of capital that will be reinforced by the distortion of the banks as intermediaries and the destruction of productive capacity.

The above discussion, points to the possibility that while the impulses of the banks, the private sector, and of governments is to tighten the belts, such moves while reflecting prudence and virtue on the surface, could well contain seeds of self?destruction where deficits grow, unemployment remains stubbornly high, growth stagnates, and disarray prevails where investors will be looking for the safest of assets (hopefully not in paper).

The ride continues with exciting routes!