Could it be that the over-collateralization and re-hypothecation of paper assets via the derivatives avenue has created a huge hole in the financial system that the monetary authorities are called to fill in order to save the day? If that could serve as our null hypothesis, then it could follow that the equities’ boost is the symptom of this wider attempt to fill the huge collateral gap, which according to the Treasury Borrowing Advisory Committee (TBAC) is around $5.7 trillion and under stressed scenarios could reach $11.2 trillion. If that is the case, then would it surprise us to see attempts to recapitalize the banks via bail-in procedures where depositors’ funds over the insured limit end up re-capitalizing the banks? And, would it surprise us if we end up seeing – among other non-conventional measures – central banks buying stocks and directly lending to businesses? I believe that we are in the process of witnessing an historical monetary regime change, and the few chapters we have seen (unorthodox quantitative easing measures, bailing out the biggest banks, bailing-in Cypriot depositors, etc.) serve only as the prelude of a book whose end may be tragic.

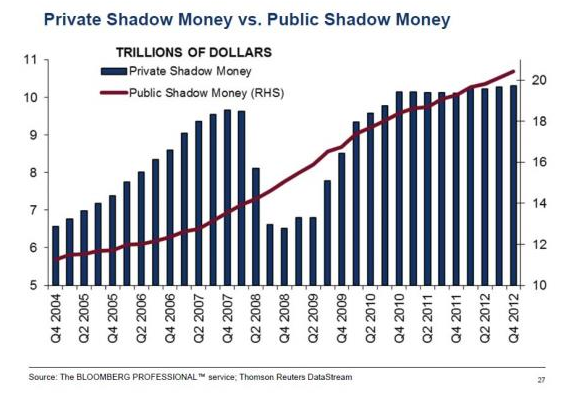

The following graph shows what this over-collateralization process has done to the flow of funds in the shadow (public and private) banking system. We observe that the two together have claims of over $30 trillion, and the collateral hole we mentioned above represents somewhere between 20 and 35% of this shadow money.

Given the fact that business appetite for real investment activity is slow, capital formation is not taking place at normal rates, and thus wealth is not created at a pace that could fill this gap. Hence, unorthodox monetary measures are taken, in order to create at least the façade of stability and wealth creation. We believe that this will continue in the foreseeable future, and thus we could argue that the equities (including cyclical sectors as we wrote a few days ago) may continue enjoying good returns.

If financial investors are convinced that the tide is turning, then risk appetite will start shifting, consumer sentiment and spending will be uplifted, and that may buy some additional time. As fear premium declines, traditional safe havens (including precious metals) experience outflows while bail-in incidents or fear of those push depositors into alternative options that will either advance consumer spending, investment activity (e.g. real estate), or risk taking, all of which boost lending activity and the combination of all may advance capital formation (if it misallocated may not be of concern given that the system is in jeopardy and collateral needs to be created to fill the gap).

I close this brief commentary by reiterating the position we have been stating since the end of last year. The aura of equities market that we foresaw late last year is still blowing and we anticipate that it will keep blowing for the foreseeable future.

At the Intersection of Equities Road and Monetary Boulevard: Seeking Collateral Base

Author : John E. Charalambakis

Date : May 15, 2013

Could it be that the over-collateralization and re-hypothecation of paper assets via the derivatives avenue has created a huge hole in the financial system that the monetary authorities are called to fill in order to save the day? If that could serve as our null hypothesis, then it could follow that the equities’ boost is the symptom of this wider attempt to fill the huge collateral gap, which according to the Treasury Borrowing Advisory Committee (TBAC) is around $5.7 trillion and under stressed scenarios could reach $11.2 trillion. If that is the case, then would it surprise us to see attempts to recapitalize the banks via bail-in procedures where depositors’ funds over the insured limit end up re-capitalizing the banks? And, would it surprise us if we end up seeing – among other non-conventional measures – central banks buying stocks and directly lending to businesses? I believe that we are in the process of witnessing an historical monetary regime change, and the few chapters we have seen (unorthodox quantitative easing measures, bailing out the biggest banks, bailing-in Cypriot depositors, etc.) serve only as the prelude of a book whose end may be tragic.

The following graph shows what this over-collateralization process has done to the flow of funds in the shadow (public and private) banking system. We observe that the two together have claims of over $30 trillion, and the collateral hole we mentioned above represents somewhere between 20 and 35% of this shadow money.

Given the fact that business appetite for real investment activity is slow, capital formation is not taking place at normal rates, and thus wealth is not created at a pace that could fill this gap. Hence, unorthodox monetary measures are taken, in order to create at least the façade of stability and wealth creation. We believe that this will continue in the foreseeable future, and thus we could argue that the equities (including cyclical sectors as we wrote a few days ago) may continue enjoying good returns.

If financial investors are convinced that the tide is turning, then risk appetite will start shifting, consumer sentiment and spending will be uplifted, and that may buy some additional time. As fear premium declines, traditional safe havens (including precious metals) experience outflows while bail-in incidents or fear of those push depositors into alternative options that will either advance consumer spending, investment activity (e.g. real estate), or risk taking, all of which boost lending activity and the combination of all may advance capital formation (if it misallocated may not be of concern given that the system is in jeopardy and collateral needs to be created to fill the gap).

I close this brief commentary by reiterating the position we have been stating since the end of last year. The aura of equities market that we foresaw late last year is still blowing and we anticipate that it will keep blowing for the foreseeable future.