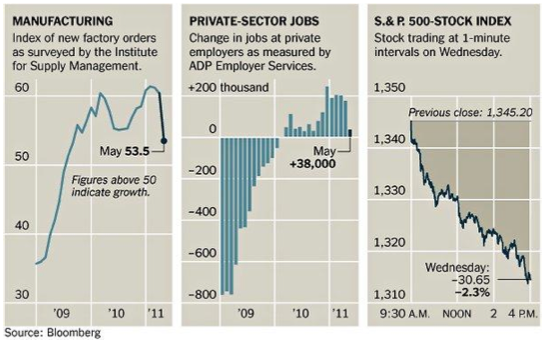

Last Wednesday the employment and production news had significant negative effects for equities. Major indexes dropped by close to 2.3%, the worst drop this year. Private sector payrolls increased insignificantly, while production slowed down significantly. These signs may point out to the possibility that the recovery is fragile in an environment of debt uncertainty. The figures below portray the fear of the markets, given these latest reports.

The debt uncertainty centers on both sides of the Atlantic, while in the Pacific Japan may experience another downgrade, also due to its debt and economic struggles. In the US, the House of Representatives failed to pass a debt ceiling increase (as expected). It seems that politics has taken control over the interests of the country.

In Europe, the debt crisis focuses on Greece, but the problem is much larger as we pointed out on our commentary on May 29th. The uncertainty centers on the fact that they cannot identify the bottom of a potential haircut/restructuring/default. If such a bottom could be pointed out, then the upswing could start. If not, then the domino effect will affect banks and other financial institutions such as insurance companies throughout Europe. Even the European Central Bank (ECB) may be affected.

On the contrary, they are trying to bail Greece out by loading the country with more debt and more measures of austerity! Inflating a country’s debt, while cutting the sources of aggregate demand, has the potential of a debt-deflation cycle that could lead to local depression. Countries such as Portugal, Greece, and Ireland, signed austerity bailout packages at rates that far exceeded their growth rates!

Now, that they still cannot borrow from the bond market and existing instruments need refinancing, they are offered more loans! When will this madness stop? This is beyond being absurd and unwise. When will they be able to pay back the loans? Where is the bottom? Where is the growth? Where are the jobs? Which are the prospects? Which is the historical precedent that a nation grew out of its problems by borrowing more at rates they cannot afford?

The prosperity of the nation does not depend upon its ability to borrow and consume, but upon its ability to produce, given that the light at the end of the tunnel is not an incoming train!

It is our motto, that preservation of capital should be goal #1 in investment management. From that perspective, keeping 18-20% in cash or cash-equivalents might be prudent and that’s what we have been doing. Our composite returns since the beginning of the year despite our allocation in cash or cash equivalents equals 13.44%1 compared to the S&P 500 which returned 5.25%2.

However, as things evolve under the current circumstances, they point out to an incoming storm. Here are the elements of such an assessment:

- The EU debt crisis is threatening to cause a domino effect that will affect all EU financial institutions, including the ECB.

- If the domino effect starts, then US financial institutions will be affected too, via the web of the very complex relationships that exist between EU and US institutions through swaps, derivatives, repos, and questionable paper assets.

- The Fed’s balance sheet will be affected, at a time when it is leveraged 50:1, meaning that the Fed’s own capital might be at risk.

- Liquidity concerns will be highlighted, given that crowded trades have placed investors on the down side of the risk-adjusted return. The over-extended investors – via leverage – who are crowded will find themselves in thin markets since they will all be sellers, creating market imbalances, exacerbating liquidity issues.

- Japan faces a downgrade at a time of recessionary pressures.

- US recovery is becoming more fragile, consumers seem unwilling to spend, housing exhibits more signs of stress, while confidence is eroding.

- The Chinese economy is slowing down.

- Financial cushions are getting thinner.

- The Fed’s QE2 is coming to an end and along with it the swap lines with the ECB and other central banks.

- Volatility is on the rise.

- The N. Africa and Middle East turmoil continues.

- The politics of the US debt ceiling could create havoc in the markets, while the room for stimulus is non-existent.

In the midst of all these signs, we anticipate the rising volatility to present some opportunities, precious metals (especially gold) to be seen as a safe haven, equities to be viewed as overvalued, while securities that are cushioned by strong dividends to move sideways.

It promises to be an interesting ride.

1 Time weighted returns from 1/3/11-5/31/11

2 http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf–p-us-l–

Assessing the Risks of an Economic & Financial Storm: Implications for Portfolio Holdings

Author : John E. Charalambakis

Date : June 3, 2011

Last Wednesday the employment and production news had significant negative effects for equities. Major indexes dropped by close to 2.3%, the worst drop this year. Private sector payrolls increased insignificantly, while production slowed down significantly. These signs may point out to the possibility that the recovery is fragile in an environment of debt uncertainty. The figures below portray the fear of the markets, given these latest reports.

The debt uncertainty centers on both sides of the Atlantic, while in the Pacific Japan may experience another downgrade, also due to its debt and economic struggles. In the US, the House of Representatives failed to pass a debt ceiling increase (as expected). It seems that politics has taken control over the interests of the country.

In Europe, the debt crisis focuses on Greece, but the problem is much larger as we pointed out on our commentary on May 29th. The uncertainty centers on the fact that they cannot identify the bottom of a potential haircut/restructuring/default. If such a bottom could be pointed out, then the upswing could start. If not, then the domino effect will affect banks and other financial institutions such as insurance companies throughout Europe. Even the European Central Bank (ECB) may be affected.

On the contrary, they are trying to bail Greece out by loading the country with more debt and more measures of austerity! Inflating a country’s debt, while cutting the sources of aggregate demand, has the potential of a debt-deflation cycle that could lead to local depression. Countries such as Portugal, Greece, and Ireland, signed austerity bailout packages at rates that far exceeded their growth rates!

Now, that they still cannot borrow from the bond market and existing instruments need refinancing, they are offered more loans! When will this madness stop? This is beyond being absurd and unwise. When will they be able to pay back the loans? Where is the bottom? Where is the growth? Where are the jobs? Which are the prospects? Which is the historical precedent that a nation grew out of its problems by borrowing more at rates they cannot afford?

The prosperity of the nation does not depend upon its ability to borrow and consume, but upon its ability to produce, given that the light at the end of the tunnel is not an incoming train!

It is our motto, that preservation of capital should be goal #1 in investment management. From that perspective, keeping 18-20% in cash or cash-equivalents might be prudent and that’s what we have been doing. Our composite returns since the beginning of the year despite our allocation in cash or cash equivalents equals 13.44%1 compared to the S&P 500 which returned 5.25%2.

However, as things evolve under the current circumstances, they point out to an incoming storm. Here are the elements of such an assessment:

In the midst of all these signs, we anticipate the rising volatility to present some opportunities, precious metals (especially gold) to be seen as a safe haven, equities to be viewed as overvalued, while securities that are cushioned by strong dividends to move sideways.

It promises to be an interesting ride.

1 Time weighted returns from 1/3/11-5/31/11

2 http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf–p-us-l–