As we go down the road where the improbable becomes probable and the non-tradable becomes tradable, we discuss below four possible outcomes that could alter the investment landscape. Those four are: The recently discovered offshore Egyptian energy resources; the moving election landscape in France; the snap elections in Great Britain, and the forthcoming downsizing of the Fed’s balance sheet.

Let’s start with the energy-related developments in the Mediterranean Sea. The newly discovered hydrocarbons in the Zohr gas field that belongs to the exclusive economic zone of Egypt, has the probability of changing the energy dynamics not only in the Mediterranean Sea but also globally, especially when we take into account the other energy developments in the area (Lebanon, Cyprus, Israel, Greece). It is not a coincident that the US and US-based companies are actively involved in explorations and negotiations, signifying the role that Egypt could play in the foreseeable future.

We believe that special attention should be placed in the triangle made up of Egypt, Cyprus, and Israel.

If things develop as some analysts portray, then the Eastern Mediterranean Sea will play a significant role in energy matters, especially for Europe, limiting the role of Russia. (It may not be an accident then that Russia insists on its involvement in the warm waters of the Mediterranean through Syria).

Under those scenarios, the Eastern part of the Mediterranean could become a southern “Norway”.

If – according to some estimates – the gas reserves in the Zohr field is between 60-100 trillion cubic feet, then we are talking about a game change whose impact will be felt in economies and markets around the globe and whose consequences could boost significantly the prospects of the countries involved.

Moving now to the French election landscape, we are observing some developments that make us contemplate that some hedging might be prudent. The first round of the election is this coming Sunday. The possibility of a runoff election on May 7th between the far-right candidate (Marine Le Pen) and the far-left (Jean-Luc Melenchon) has been rising over the course of the last two weeks, making it a race among four persons (Macron, Fillon, Le Pen, and Melenchon) a real possibility.

So far the effect of this development is a selloff of French bonds and consequently a rising in French long term interest rates. If such a surprise materializes on Sunday, then EU peripheral countries’ bonds (Italian, Spanish, Greek, Portuguese, etc.), may experience a significant selloff come early next week, and the equity markets too may also experience a selloff. We also expect the Euro to drop significantly under this scenario.

On the other hand, if two mainstream candidates emerge on Sunday’s first round, we anticipate some kind of a rally in European equities.

The snap elections called in Great Britain by PM Theresa May for June 8th, are intended to give her government a strong mandate for the Brexit talks. However, the consequences of such political calculations could be that the unexpected might happen (Labor to win the elections) or most probably to harden the EU positions which may lead to a hard exit with significantly negative consequences for the UK economy, especially if EU revitalization is seen as a real possibility with a Macron Presidency in France.

Already the EU has started freezing UK-companies from EU contracts, and the negotiations could take a very long time (it is quite unrealistic to expect them to be concluded within 18-20 months).

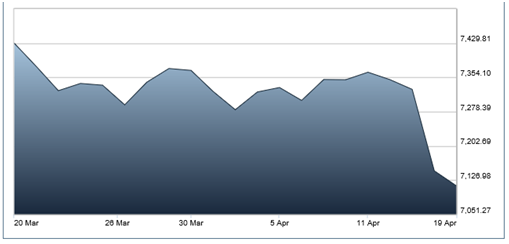

Our concern is that when politics start dictating the rules rather than allow institutional rules to play out, then the emerging volatility will lead to a rising uncertainty and the latter will have investors fleeing for safety, especially when someone takes into consideration that PM May was an opponent of Brexit and now is a committed supporter. The markets sooner or later desire clear thinking and conviction rather than swings according to where the wind blows. It’s no wonder then that the FTSE 100 has experienced a significant decline over the course of the last month as it is shown below.

We would close this week’s commentary with some thoughts related to the downsizing of the Fed’s balance sheet. It seems that the time is coming for the next phase in monetary policy normalization when the Fed will wind down its holdings of government bonds and mortgage-backed securities.

As the Fed stops reinvesting the proceeds from maturing securities, its balance sheet will automatically shrink. Such move could potentially drive interest rates higher and further strengthen the dollar, especially if the EU and the UK are in a state of disarray.

The winding down of the Fed’s balance sheet without similar moves by the central banks of Europe and Japan (where the latter has also been buying stocks and funds and not just government bonds), could lead to an asymmetrical and uncoordinated global monetary policy which could further advance uncertainty and fear.

In conclusion, we would say that policy confusion coupled with political uncertainty make a toxic mix that requires some kind of hedging. If on the other hand, EU elections do not produce any major surprises, then the EU markets could advance and the ECB could join next year the Fed in shrinking its balance, which will portray monetary normalization and can boost the markets further.

Assessing Possible High Impact Outcomes: From Egypt to France, and from London to D.C.

Author : John E. Charalambakis

Date : April 20, 2017

As we go down the road where the improbable becomes probable and the non-tradable becomes tradable, we discuss below four possible outcomes that could alter the investment landscape. Those four are: The recently discovered offshore Egyptian energy resources; the moving election landscape in France; the snap elections in Great Britain, and the forthcoming downsizing of the Fed’s balance sheet.

Let’s start with the energy-related developments in the Mediterranean Sea. The newly discovered hydrocarbons in the Zohr gas field that belongs to the exclusive economic zone of Egypt, has the probability of changing the energy dynamics not only in the Mediterranean Sea but also globally, especially when we take into account the other energy developments in the area (Lebanon, Cyprus, Israel, Greece). It is not a coincident that the US and US-based companies are actively involved in explorations and negotiations, signifying the role that Egypt could play in the foreseeable future.

We believe that special attention should be placed in the triangle made up of Egypt, Cyprus, and Israel.

If things develop as some analysts portray, then the Eastern Mediterranean Sea will play a significant role in energy matters, especially for Europe, limiting the role of Russia. (It may not be an accident then that Russia insists on its involvement in the warm waters of the Mediterranean through Syria).

Under those scenarios, the Eastern part of the Mediterranean could become a southern “Norway”.

If – according to some estimates – the gas reserves in the Zohr field is between 60-100 trillion cubic feet, then we are talking about a game change whose impact will be felt in economies and markets around the globe and whose consequences could boost significantly the prospects of the countries involved.

Moving now to the French election landscape, we are observing some developments that make us contemplate that some hedging might be prudent. The first round of the election is this coming Sunday. The possibility of a runoff election on May 7th between the far-right candidate (Marine Le Pen) and the far-left (Jean-Luc Melenchon) has been rising over the course of the last two weeks, making it a race among four persons (Macron, Fillon, Le Pen, and Melenchon) a real possibility.

So far the effect of this development is a selloff of French bonds and consequently a rising in French long term interest rates. If such a surprise materializes on Sunday, then EU peripheral countries’ bonds (Italian, Spanish, Greek, Portuguese, etc.), may experience a significant selloff come early next week, and the equity markets too may also experience a selloff. We also expect the Euro to drop significantly under this scenario.

On the other hand, if two mainstream candidates emerge on Sunday’s first round, we anticipate some kind of a rally in European equities.

The snap elections called in Great Britain by PM Theresa May for June 8th, are intended to give her government a strong mandate for the Brexit talks. However, the consequences of such political calculations could be that the unexpected might happen (Labor to win the elections) or most probably to harden the EU positions which may lead to a hard exit with significantly negative consequences for the UK economy, especially if EU revitalization is seen as a real possibility with a Macron Presidency in France.

Already the EU has started freezing UK-companies from EU contracts, and the negotiations could take a very long time (it is quite unrealistic to expect them to be concluded within 18-20 months).

Our concern is that when politics start dictating the rules rather than allow institutional rules to play out, then the emerging volatility will lead to a rising uncertainty and the latter will have investors fleeing for safety, especially when someone takes into consideration that PM May was an opponent of Brexit and now is a committed supporter. The markets sooner or later desire clear thinking and conviction rather than swings according to where the wind blows. It’s no wonder then that the FTSE 100 has experienced a significant decline over the course of the last month as it is shown below.

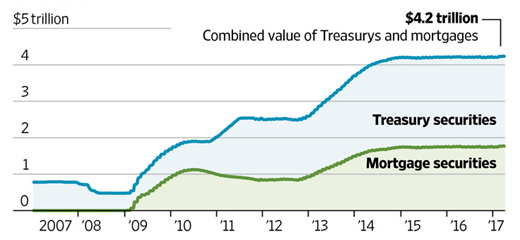

We would close this week’s commentary with some thoughts related to the downsizing of the Fed’s balance sheet. It seems that the time is coming for the next phase in monetary policy normalization when the Fed will wind down its holdings of government bonds and mortgage-backed securities.

As the Fed stops reinvesting the proceeds from maturing securities, its balance sheet will automatically shrink. Such move could potentially drive interest rates higher and further strengthen the dollar, especially if the EU and the UK are in a state of disarray.

The winding down of the Fed’s balance sheet without similar moves by the central banks of Europe and Japan (where the latter has also been buying stocks and funds and not just government bonds), could lead to an asymmetrical and uncoordinated global monetary policy which could further advance uncertainty and fear.

In conclusion, we would say that policy confusion coupled with political uncertainty make a toxic mix that requires some kind of hedging. If on the other hand, EU elections do not produce any major surprises, then the EU markets could advance and the ECB could join next year the Fed in shrinking its balance, which will portray monetary normalization and can boost the markets further.