As an opening statement allow us to paraphrase David Liss’ claim in his novel A Conspiracy of Paper, where he claims that finance is an animal, and the government needs to decide how big the cage should be. In a few days we will be entering August. The memories of August 15, 1971 and of August 19, 1991 will come back (not to mention of the market gyrations that started in August 1987 and culminated with the stock market crash on October 19, 1987; and of the August 2007 events that unleash the recent financial meltdown).

In 1971 the global financial vessel lost its golden anchor and the financial “innovation” that it unleashed with all those fancy but toxic papers (especially in the last decade) produced a lot of pain, crashes, financial anxieties, paper “wealth” that can evaporate overnight, and significant distortions. (There were a couple of positive elements too, as we acknowledge at the end of this commentary). Losing that anchor has had the result of a crisis every few years (oil in 1973 & 1979; Latin America bonds in the early 1980s; currency in the mid 1980s; S&L banking crisis in the late 1980s; Mexican, South East Asian, Russian, and Latin American in the mid and late 1990s; stock market crash and technology bubble in early 21st century; housing and toxic “asset” bubble, to name a few of those crises).

In mid August 1991, communism collapsed. The failed coup in Moscow buried for good communism’s dream a.k.a. the utopia of the proletariat. The collapse of the Soviet Union unleashed productive powers and assets that transformed Eastern and Western Europe, and also advanced the interests of all countries around the world. It was a win-win situation for all.

This summer we are at a similar cross-road. US growth seems to be fragile and stagnant. Policies applied in the beginning of the century destroyed to a large extent the financial, economic, and moral fabric of the nation. Fiscal discipline was completely lost and surpluses were squandered. Causes were adopted without proper exits. Tax revenues are at an all-time low as a fraction of the GDP.

The EU is in a worse shape, financially and economically. Its peripheral economies suffer from recessionary pressures, deficits, huge debts, high unemployment, no prospects for healthy growth, and its bank’s balance sheets contain questionable “assets”. Worse yet, the lack of leadership and vision exacerbate its problems.

China has its own wall of financial steroids (see our September 2010 newsletter). Its many bubbles may cause a series of significant problems around the globe, if they burst.

For a few months now, we are debating in the US the raising of our debt ceiling. As Chairman Volcker said recently, we should not be concerned about the rating agencies warnings. They surely missed the boat, last time around and contributed significantly in the recent financial collapse by extending AAA rating to toxic paper. The US has real assets, the capacity and the capability to face its challenges and never be questioned about its ability to meet its obligations. We will also bypass the constitutionality for the Congressional need the debt ceiling.

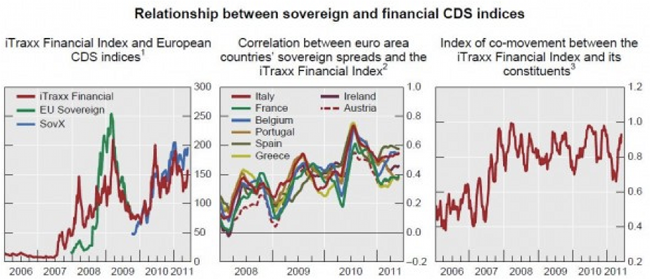

A recent paper by the Global Committee on Financial Stability (GCFS), suggests that there is a vicious cycle between accumulation of sovereign debt and the health of the banking sector, i.e. the health of the financial system. Specifically, and as the following graph shows, the more the banks are encouraged to hold sovereign debt, the higher their finding costs end up being, and via leverage positions (for sovereign debt rated A- the leverage could be 62:1) and the inter-bank lending sector, the funding costs are highly correlated which puts the whole system at risk.

Now, as funding costs worsens so does the creditworthiness of the sovereign, and hence the high correlations and the vicious cycle. In such a case the credit rating is not a good guide since it is self-defeating. The intoxicated ratings misallocate capital and distort risk profiles, making investors to think of imaginative risk-free returns and assets that are nothing but liabilities of someone else, in an era where sovereign defaults may become a real possibility.

At this point, we would claim that it’s a great opportunity to push the re-start button in our economy and re-discover the essence of what real economic growth is, not based on credit that is over-extended and using camouflaged “assets” as collateral. Real economic growth is reflected in productivity increases, in high employment, in reflective budgets that exhibit surpluses in good times that can be spent in bad times, in declining debts, in higher incomes for all and not just for a few, and in opportunities for businesses to expand and reward their stakeholders. The time is ripe for such a re-start.

A good re-starting point is in our opinion now, and could be done by an official revaluation of our gold reserves. Our gold reserves are valued at approximately $42.22 per ounce. A banking catharsis took place in the mid 1930s when it was first implemented, while the second time it stopped a financial hemorrhage and awoke dormant assets.

Ode to an awakening of dormant assets!

Anchoring Optimism in an Era of Anxiety: Reflections on Debt & Financial Stability

Author : John E. Charalambakis

Date : July 21, 2011

As an opening statement allow us to paraphrase David Liss’ claim in his novel A Conspiracy of Paper, where he claims that finance is an animal, and the government needs to decide how big the cage should be. In a few days we will be entering August. The memories of August 15, 1971 and of August 19, 1991 will come back (not to mention of the market gyrations that started in August 1987 and culminated with the stock market crash on October 19, 1987; and of the August 2007 events that unleash the recent financial meltdown).

In 1971 the global financial vessel lost its golden anchor and the financial “innovation” that it unleashed with all those fancy but toxic papers (especially in the last decade) produced a lot of pain, crashes, financial anxieties, paper “wealth” that can evaporate overnight, and significant distortions. (There were a couple of positive elements too, as we acknowledge at the end of this commentary). Losing that anchor has had the result of a crisis every few years (oil in 1973 & 1979; Latin America bonds in the early 1980s; currency in the mid 1980s; S&L banking crisis in the late 1980s; Mexican, South East Asian, Russian, and Latin American in the mid and late 1990s; stock market crash and technology bubble in early 21st century; housing and toxic “asset” bubble, to name a few of those crises).

In mid August 1991, communism collapsed. The failed coup in Moscow buried for good communism’s dream a.k.a. the utopia of the proletariat. The collapse of the Soviet Union unleashed productive powers and assets that transformed Eastern and Western Europe, and also advanced the interests of all countries around the world. It was a win-win situation for all.

This summer we are at a similar cross-road. US growth seems to be fragile and stagnant. Policies applied in the beginning of the century destroyed to a large extent the financial, economic, and moral fabric of the nation. Fiscal discipline was completely lost and surpluses were squandered. Causes were adopted without proper exits. Tax revenues are at an all-time low as a fraction of the GDP.

The EU is in a worse shape, financially and economically. Its peripheral economies suffer from recessionary pressures, deficits, huge debts, high unemployment, no prospects for healthy growth, and its bank’s balance sheets contain questionable “assets”. Worse yet, the lack of leadership and vision exacerbate its problems.

China has its own wall of financial steroids (see our September 2010 newsletter). Its many bubbles may cause a series of significant problems around the globe, if they burst.

For a few months now, we are debating in the US the raising of our debt ceiling. As Chairman Volcker said recently, we should not be concerned about the rating agencies warnings. They surely missed the boat, last time around and contributed significantly in the recent financial collapse by extending AAA rating to toxic paper. The US has real assets, the capacity and the capability to face its challenges and never be questioned about its ability to meet its obligations. We will also bypass the constitutionality for the Congressional need the debt ceiling.

A recent paper by the Global Committee on Financial Stability (GCFS), suggests that there is a vicious cycle between accumulation of sovereign debt and the health of the banking sector, i.e. the health of the financial system. Specifically, and as the following graph shows, the more the banks are encouraged to hold sovereign debt, the higher their finding costs end up being, and via leverage positions (for sovereign debt rated A- the leverage could be 62:1) and the inter-bank lending sector, the funding costs are highly correlated which puts the whole system at risk.

Now, as funding costs worsens so does the creditworthiness of the sovereign, and hence the high correlations and the vicious cycle. In such a case the credit rating is not a good guide since it is self-defeating. The intoxicated ratings misallocate capital and distort risk profiles, making investors to think of imaginative risk-free returns and assets that are nothing but liabilities of someone else, in an era where sovereign defaults may become a real possibility.

At this point, we would claim that it’s a great opportunity to push the re-start button in our economy and re-discover the essence of what real economic growth is, not based on credit that is over-extended and using camouflaged “assets” as collateral. Real economic growth is reflected in productivity increases, in high employment, in reflective budgets that exhibit surpluses in good times that can be spent in bad times, in declining debts, in higher incomes for all and not just for a few, and in opportunities for businesses to expand and reward their stakeholders. The time is ripe for such a re-start.

A good re-starting point is in our opinion now, and could be done by an official revaluation of our gold reserves. Our gold reserves are valued at approximately $42.22 per ounce. A banking catharsis took place in the mid 1930s when it was first implemented, while the second time it stopped a financial hemorrhage and awoke dormant assets.

Ode to an awakening of dormant assets!