The old anthem of imperial Europe cried out, “Hail, Europe, our true Fatherland”, and Italy nowadays enters its own phase of the Eurozone crisis. Italian bonds’ spreads over Germany’s Bunds have risen to their highest levels since 2002, as the following graph shows. Hedge funds are shorting Italian bonds, hoping that the sovereign debt crisis will hit Italy’s markets and thus gain from the falling bond prices.

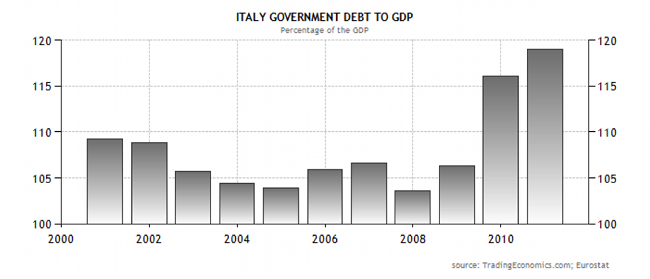

Italy is forced to pay a premium for its debt and the higher yields may signify further problems for the Eurozone, since Italy has the highest debt to GDP ratio (120%) among all members of the Eurozone. The figure below shows the significant increases in Italian yields.

Italian spreads over German Bunds are up by 31% in one month, while Italian bonds’ yields have increased 9.51% during the same month.

Italy needs to refinance close to $250 billion in the next six months and another $350 billion in 2012. Furthermore, over the next four years Italy needs to refinance close to $1.2 trillion of bonds, and given the market gyrations and uncertainties it will either have to swallow paying higher yields, or may be forced to austerity measures amplified by a form of a rescue that would shatter the Eurozone prospects for a long time.

The risks at this time focus on contagion in other European markets. The Spanish spreads are testing resistance levels as the following graph demonstrates.

A leverage ETN (Exchange Traded Note) that speculates on the spread between the Italian 10-year bond and the German Bund has gained over 17% in a month, as the figure below shows.

Italian Finance minister Mr. Tremonti claims that if he falls (Prime Minister Berlousconi publicly denounced some of his plans) then Italy would fall and so will the Euro. If the contagion fever breaks out, then it may not be possible for the crisis to be contained, and hence we will be talking of a solvency rather than a liquidity crisis. The consequences would be severe for both EU and US banks that are exposed to Italian paper in the hundreds of billions of dollars directly as well as indirectly through derivatives instruments.

The Italian banking powerhouse UniCredit suffered significant share price losses last Friday and its trading was suspended temporarily due to those losses. We are not afraid that such Italian powerhouses will collapse, given the history and commitments of governments to bail them out, however, as bond prices fall and private investors start abandoning the Italian paper, banks’ balance sheets will be affected worldwide that will force them to tighten credit and hence a recession will become imminent, spreading throughout the European land, crying out “ave Europa nostra vera patria”, while observing Italy’s debt shown below.

Someone may ask, “What about our own predicament of default in the US?” We shall return to that topic soon, but for the moment we will allow another old Latin phrase to express our view:

Ad kalendas graecas!

An Italian Twist in the Eurozone Crisis: Ave Europa Nostra Vera Patria

Author : John E. Charalambakis

Date : July 11, 2011

The old anthem of imperial Europe cried out, “Hail, Europe, our true Fatherland”, and Italy nowadays enters its own phase of the Eurozone crisis. Italian bonds’ spreads over Germany’s Bunds have risen to their highest levels since 2002, as the following graph shows. Hedge funds are shorting Italian bonds, hoping that the sovereign debt crisis will hit Italy’s markets and thus gain from the falling bond prices.

Italy is forced to pay a premium for its debt and the higher yields may signify further problems for the Eurozone, since Italy has the highest debt to GDP ratio (120%) among all members of the Eurozone. The figure below shows the significant increases in Italian yields.

Italian spreads over German Bunds are up by 31% in one month, while Italian bonds’ yields have increased 9.51% during the same month.

Italy needs to refinance close to $250 billion in the next six months and another $350 billion in 2012. Furthermore, over the next four years Italy needs to refinance close to $1.2 trillion of bonds, and given the market gyrations and uncertainties it will either have to swallow paying higher yields, or may be forced to austerity measures amplified by a form of a rescue that would shatter the Eurozone prospects for a long time.

The risks at this time focus on contagion in other European markets. The Spanish spreads are testing resistance levels as the following graph demonstrates.

A leverage ETN (Exchange Traded Note) that speculates on the spread between the Italian 10-year bond and the German Bund has gained over 17% in a month, as the figure below shows.

Italian Finance minister Mr. Tremonti claims that if he falls (Prime Minister Berlousconi publicly denounced some of his plans) then Italy would fall and so will the Euro. If the contagion fever breaks out, then it may not be possible for the crisis to be contained, and hence we will be talking of a solvency rather than a liquidity crisis. The consequences would be severe for both EU and US banks that are exposed to Italian paper in the hundreds of billions of dollars directly as well as indirectly through derivatives instruments.

The Italian banking powerhouse UniCredit suffered significant share price losses last Friday and its trading was suspended temporarily due to those losses. We are not afraid that such Italian powerhouses will collapse, given the history and commitments of governments to bail them out, however, as bond prices fall and private investors start abandoning the Italian paper, banks’ balance sheets will be affected worldwide that will force them to tighten credit and hence a recession will become imminent, spreading throughout the European land, crying out “ave Europa nostra vera patria”, while observing Italy’s debt shown below.

Someone may ask, “What about our own predicament of default in the US?” We shall return to that topic soon, but for the moment we will allow another old Latin phrase to express our view:

Ad kalendas graecas!