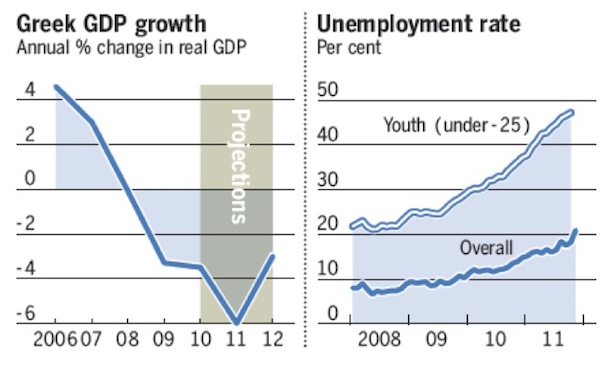

The calls heard last week from the southern periphery of the EU seem to be coming from the abyss. The Greek economy is in her fifth year of contraction, the official unemployment rate has hit 20 percent, and more austerity is on the horizon for at least the next 3-4 years. The recent measures follow the rationale that addition is through subtraction (it’s called the new math!) The figure below says the story.

Given the dramatic deterioration of Greek economic and financial indicators, we would not be surprised if the Greek economy reverts back to a new national currency. If that happens while Greece still has some leverage within the EU – meaning that her default could trigger an EU wide shakeout – then, we anticipate that the liquidity premium will increase substantially within the EU. Friday’s market turmoil –reminiscent of previous similar turmoil – is indicative of a neglected phenomenon that has the potential of creating a financial black hole throughout the EU.

The short term demand and supply for liquid assets is inelastic, hence a small shock (such as one generated in Greece) can produce a large spike in the liquidity premium (something that the central banks do not target), and turn paper assets into illiquid instruments with higher probability of default.

Against that and of course in relation to the EU-banking system funding problems, the ECB last Thursday lowered once again the collateral standards for loans. The immediate effect of the higher liquidity premium would be a market-wide increase in interest rates that will affect every single asset class and depending on the idiosyncrasies of the banks’ balance sheets (including central banks’ balance sheets), a minor event can have catastrophic consequences (see a relevant piece in our November 2010 newsletter).

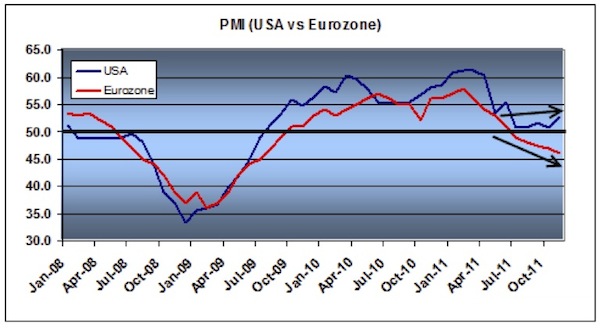

Last week, the EU entered into a recession. Given that and the discussion above, we are of the opinion that the facts point to a decoupling between the EU and the US and the conditions favor the US for capital inflows. The graph below is indicative of that decoupling trend, something that we also have pointed out before. It shows that the Purchasing Managers’ Index (PMI) has been declining for months in the EU, while it has been rising in the US. Such decoupling will exacerbate EU’s pains.

The decoupling between the US and the EU is based not just on production activities, but also on relative banks’ strength, markets’ strength, market confidence, political leadership or the lack thereof, as well as on corrective measures taken to overcome fiscal and monetary challenges with the eyes focused on jobs, incomes, and business activity.

Abyssus Abyssum Invocat: On Liquidity Premiums and the Broadening of the Collateral Base

Author : John E. Charalambakis

Date : February 11, 2012

The calls heard last week from the southern periphery of the EU seem to be coming from the abyss. The Greek economy is in her fifth year of contraction, the official unemployment rate has hit 20 percent, and more austerity is on the horizon for at least the next 3-4 years. The recent measures follow the rationale that addition is through subtraction (it’s called the new math!) The figure below says the story.

Given the dramatic deterioration of Greek economic and financial indicators, we would not be surprised if the Greek economy reverts back to a new national currency. If that happens while Greece still has some leverage within the EU – meaning that her default could trigger an EU wide shakeout – then, we anticipate that the liquidity premium will increase substantially within the EU. Friday’s market turmoil –reminiscent of previous similar turmoil – is indicative of a neglected phenomenon that has the potential of creating a financial black hole throughout the EU.

The short term demand and supply for liquid assets is inelastic, hence a small shock (such as one generated in Greece) can produce a large spike in the liquidity premium (something that the central banks do not target), and turn paper assets into illiquid instruments with higher probability of default.

Against that and of course in relation to the EU-banking system funding problems, the ECB last Thursday lowered once again the collateral standards for loans. The immediate effect of the higher liquidity premium would be a market-wide increase in interest rates that will affect every single asset class and depending on the idiosyncrasies of the banks’ balance sheets (including central banks’ balance sheets), a minor event can have catastrophic consequences (see a relevant piece in our November 2010 newsletter).

Last week, the EU entered into a recession. Given that and the discussion above, we are of the opinion that the facts point to a decoupling between the EU and the US and the conditions favor the US for capital inflows. The graph below is indicative of that decoupling trend, something that we also have pointed out before. It shows that the Purchasing Managers’ Index (PMI) has been declining for months in the EU, while it has been rising in the US. Such decoupling will exacerbate EU’s pains.

The decoupling between the US and the EU is based not just on production activities, but also on relative banks’ strength, markets’ strength, market confidence, political leadership or the lack thereof, as well as on corrective measures taken to overcome fiscal and monetary challenges with the eyes focused on jobs, incomes, and business activity.