Understanding market trends is more than merely intellectual gymnastics on financial and economic themes. Every market era emphasizes different aspects of its inheritance depending on its own problems. Our challenge nowadays – where a market theme is absent – is to examine customary beliefs and practices for the possibility that what has been accepted as an imponderable may be only as Veblen suggested “an article of make-believe, axiomatic by force of settled habit”. Certainty in markets’ predicted behavior is an improbable outcome due to human behavior and institutional interventions (e.g. when central banks take measures that bail out banks and corresponding markets). When such interventions take place, a truncation bias is introduced into markets’ behavior.

In the following graph I demonstrate what this truncation bias does to market behavior. Under normal circumstances the scatter diagram of the dots below would have produced a flat line as shown on the right-hand side.

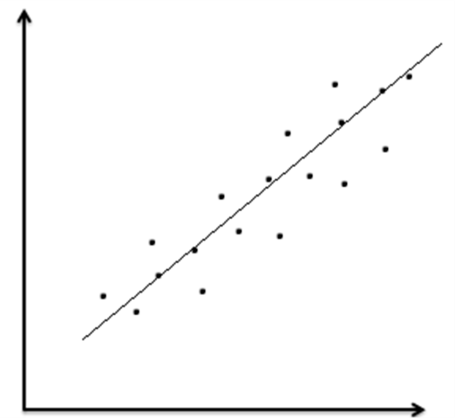

On the other hand, when institutional intervention takes place the dots of the first graph above (which could represent high debt levels, low productivity, unfunded liabilities, and troubled banks due to derivatives exposure or due to over-estimated collateral base) are ignored, and temporary emphasis is on the ephemeral potential returns due to injections in the financial system. When we ignore the lower dots we end up with an exaggerated positive line as shown below. This is the essence of truncation bias that has made market participants myopic regarding the long term.

|

|

This market shortsightedness could actually be convoluted in the sense that it has lost sight of the essential, and is focusing primarily on non-core issues that divert attention of what really matters in the long term. Therefore, the market is moved by cyclothymiac impulses some of which are short-lived within a short-term cycle. The current short-term cycle (which as we wrote late last year was expected) is a cycle of upswing that may last another 15-30 months. In that cycle – that still ignores debt levels, the shaky public and private finances, the lack of significant growth, let alone the dysfunctionalities of regimes such as the Euro zone – there will be periods of significant volatility and market corrections. I am of the opinion that the next few weeks may be reserved for such cyclothymiac behavior.

In the current short-term cycle the prices of precious metals are supposed to decline (and they have done so significantly). However, in the last few days prices of gold and silver demonstrated some strength (gold rose from about $1230 a troy ounce to about $1370, while silver rose from about $19 to around $23).

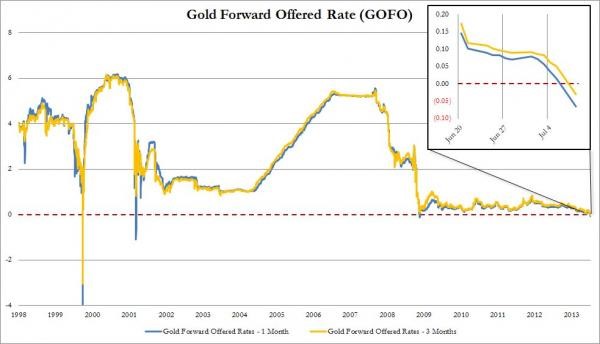

This cyclothymiac behavior of precious metals’ prices may well reflect the fact that gold forward rates (GOFO) turned negative, as shown above. When the GOFO turns negative the gold lease rate (defined as LIBOR minus GOFO) rises and as the latter rises, it may push higher the price of the precious metal. Therefore, we may be witnessing a temporary phenomenon within the short-term cycle we are in, where higher Treasury yields coincide with higher gold lease rates, while equities suffer losses. However, as the market adjusts to the new “stable” disequilibrium, it will revert to its upward (but still unjustifiable from a long-term perspective) short-term trend reminding us that “temporary lapses of reason” belong to an era that has no central theme (coincidentally Pink Floyd’s album of the same title in 1987 had no central theme).

In this cyclothymiac time interval we should not lose sight of either the short term or the long term trend. When Antigone confronted Creon (the ruler of Thebes who forbade the burial of her brother) with the following words “And if you think my acts are foolishness, the foolishness may be in the fool’s eye…” she was echoing the fact that temporary pronouncements, and exhibitions of power – even when they are institutionalized – cannot defy eternal truths, while actions have consequences that even the ruler cannot ignore (Creon’s wife and son committed suicide following Antigone’s death). Maybe policymakers from Washington D.C. to Cairo could benefit too by re-reading Sophocles’ Antigone.

A Temporary Lapse in Markets’ Trend: Truncation Bias and Shortsightedness

Author : John E. Charalambakis

Date : August 18, 2013

Understanding market trends is more than merely intellectual gymnastics on financial and economic themes. Every market era emphasizes different aspects of its inheritance depending on its own problems. Our challenge nowadays – where a market theme is absent – is to examine customary beliefs and practices for the possibility that what has been accepted as an imponderable may be only as Veblen suggested “an article of make-believe, axiomatic by force of settled habit”. Certainty in markets’ predicted behavior is an improbable outcome due to human behavior and institutional interventions (e.g. when central banks take measures that bail out banks and corresponding markets). When such interventions take place, a truncation bias is introduced into markets’ behavior.

In the following graph I demonstrate what this truncation bias does to market behavior. Under normal circumstances the scatter diagram of the dots below would have produced a flat line as shown on the right-hand side.

On the other hand, when institutional intervention takes place the dots of the first graph above (which could represent high debt levels, low productivity, unfunded liabilities, and troubled banks due to derivatives exposure or due to over-estimated collateral base) are ignored, and temporary emphasis is on the ephemeral potential returns due to injections in the financial system. When we ignore the lower dots we end up with an exaggerated positive line as shown below. This is the essence of truncation bias that has made market participants myopic regarding the long term.

This market shortsightedness could actually be convoluted in the sense that it has lost sight of the essential, and is focusing primarily on non-core issues that divert attention of what really matters in the long term. Therefore, the market is moved by cyclothymiac impulses some of which are short-lived within a short-term cycle. The current short-term cycle (which as we wrote late last year was expected) is a cycle of upswing that may last another 15-30 months. In that cycle – that still ignores debt levels, the shaky public and private finances, the lack of significant growth, let alone the dysfunctionalities of regimes such as the Euro zone – there will be periods of significant volatility and market corrections. I am of the opinion that the next few weeks may be reserved for such cyclothymiac behavior.

In the current short-term cycle the prices of precious metals are supposed to decline (and they have done so significantly). However, in the last few days prices of gold and silver demonstrated some strength (gold rose from about $1230 a troy ounce to about $1370, while silver rose from about $19 to around $23).

This cyclothymiac behavior of precious metals’ prices may well reflect the fact that gold forward rates (GOFO) turned negative, as shown above. When the GOFO turns negative the gold lease rate (defined as LIBOR minus GOFO) rises and as the latter rises, it may push higher the price of the precious metal. Therefore, we may be witnessing a temporary phenomenon within the short-term cycle we are in, where higher Treasury yields coincide with higher gold lease rates, while equities suffer losses. However, as the market adjusts to the new “stable” disequilibrium, it will revert to its upward (but still unjustifiable from a long-term perspective) short-term trend reminding us that “temporary lapses of reason” belong to an era that has no central theme (coincidentally Pink Floyd’s album of the same title in 1987 had no central theme).

In this cyclothymiac time interval we should not lose sight of either the short term or the long term trend. When Antigone confronted Creon (the ruler of Thebes who forbade the burial of her brother) with the following words “And if you think my acts are foolishness, the foolishness may be in the fool’s eye…” she was echoing the fact that temporary pronouncements, and exhibitions of power – even when they are institutionalized – cannot defy eternal truths, while actions have consequences that even the ruler cannot ignore (Creon’s wife and son committed suicide following Antigone’s death). Maybe policymakers from Washington D.C. to Cairo could benefit too by re-reading Sophocles’ Antigone.