A friend was telling me lately that it seems that there are two kinds of people: Those who chose the door that leads to paradise and those who choose the door that leads into a discussion group about the paradise. His point was that several times in our lives we miss the boat for the sake of arguing how the paradise might look like.

We believe that we live in pivotal times that will define the new era of strategic disintegration. Old traditional economies and groups of countries such as the EU – along with their currency – will be squeezed while the US and China will live symbiotically and experience growth and advanced opportunities. During the transition period of disintegration, paper assets will lose their shine, while real hard assets will start establishing again a sound base for credit creation. During that transition period we anticipate the breakup of big banks, the energy independence of the US, and changes in the geopolitical map.

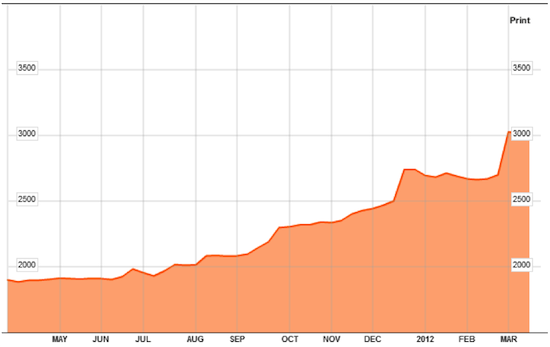

Let’s start with the recent picture of oil. The graph below (representing the price of WTI) shows us its significant increase over the last five months.

How could we explain such a significant increase? Let’s exclude what we know: demand has not increased; supply is adequate; international trade is not increasing. None of usual suspects can explain the rise in the oil prices. As we explained in an earlier commentary, we are of the opinion that prices reflect three primary factors, namely: demand & supply; risk premium, and asset collateralization premium. Having excluded the demand & supply factors, we are left to believe that it is the fear over a potential Iranian conflict that adds a premium into oil prices. At the same time, and given the higher than expected growth prospects in the US and the equity markets’ rally, oil prices follow the trend as a commodity as well as an asset class. The latter allows a stronger collateral base which in turn increases the demand for money and credit and strengthens the unit of account that measures oil prices, i.e. the US dollar. Hence we have the phenomenon where both oil and the dollar index (see graph below) rise simultaneously, over the last few months.

We are of the opinion that the upward trend of the USD may continue, even if oil prices may suspend their upward trend. The main reasons for that would be credit demand and better economic prospects.

However, since we are discussing credit demand and strategic disintegration, we also need to relate to that discussion the asset basis for such interaction. Such asset basis can be found in the huge energy reserves that are being discovered in the United States. The picture below portrays the new shale plays accessed by horizontal drilling and hydraulic fracturing, that could transform the US economy, producing millions of jobs, adding significantly to the GDP and strengthening the USD, let alone the tremendous improvements in the US balance of payments as well as the collateral geostrategic benefits.

Based on simulations and projections the US will surpass both Saudi Arabia and Russia in energy production, and thus the USD as the international reserve currency will not be questioned.

We anticipate that by the time the above is in full swing, the LTROs (the recent loans by the ECB to EU banks that postponed the collapse of the EU-wide banking system) in the EU will be called, at which time the balance sheet of the ECB (see its explosion over the last year below) will be shown as naked, and at which time the whole Euro enterprise may come to an abrupt end.

While someone might say that the Fed’s balance sheet may look similar to the ECB’s, we may differentiate from that position on two fronts: First the USD is the international reserve currency, and second the asset basis at the Fed is much stronger than the paper assets – a.k.a. toxic IOU paper – of the ECB’s collateral base.

Ode to assets that are no one else’s liabilities!

A Tale of Two Doors: Energy, the Dollar, and the ECB

Author : John E. Charalambakis

Date : March 25, 2012

A friend was telling me lately that it seems that there are two kinds of people: Those who chose the door that leads to paradise and those who choose the door that leads into a discussion group about the paradise. His point was that several times in our lives we miss the boat for the sake of arguing how the paradise might look like.

We believe that we live in pivotal times that will define the new era of strategic disintegration. Old traditional economies and groups of countries such as the EU – along with their currency – will be squeezed while the US and China will live symbiotically and experience growth and advanced opportunities. During the transition period of disintegration, paper assets will lose their shine, while real hard assets will start establishing again a sound base for credit creation. During that transition period we anticipate the breakup of big banks, the energy independence of the US, and changes in the geopolitical map.

Let’s start with the recent picture of oil. The graph below (representing the price of WTI) shows us its significant increase over the last five months.

How could we explain such a significant increase? Let’s exclude what we know: demand has not increased; supply is adequate; international trade is not increasing. None of usual suspects can explain the rise in the oil prices. As we explained in an earlier commentary, we are of the opinion that prices reflect three primary factors, namely: demand & supply; risk premium, and asset collateralization premium. Having excluded the demand & supply factors, we are left to believe that it is the fear over a potential Iranian conflict that adds a premium into oil prices. At the same time, and given the higher than expected growth prospects in the US and the equity markets’ rally, oil prices follow the trend as a commodity as well as an asset class. The latter allows a stronger collateral base which in turn increases the demand for money and credit and strengthens the unit of account that measures oil prices, i.e. the US dollar. Hence we have the phenomenon where both oil and the dollar index (see graph below) rise simultaneously, over the last few months.

We are of the opinion that the upward trend of the USD may continue, even if oil prices may suspend their upward trend. The main reasons for that would be credit demand and better economic prospects.

However, since we are discussing credit demand and strategic disintegration, we also need to relate to that discussion the asset basis for such interaction. Such asset basis can be found in the huge energy reserves that are being discovered in the United States. The picture below portrays the new shale plays accessed by horizontal drilling and hydraulic fracturing, that could transform the US economy, producing millions of jobs, adding significantly to the GDP and strengthening the USD, let alone the tremendous improvements in the US balance of payments as well as the collateral geostrategic benefits.

Based on simulations and projections the US will surpass both Saudi Arabia and Russia in energy production, and thus the USD as the international reserve currency will not be questioned.

We anticipate that by the time the above is in full swing, the LTROs (the recent loans by the ECB to EU banks that postponed the collapse of the EU-wide banking system) in the EU will be called, at which time the balance sheet of the ECB (see its explosion over the last year below) will be shown as naked, and at which time the whole Euro enterprise may come to an abrupt end.

While someone might say that the Fed’s balance sheet may look similar to the ECB’s, we may differentiate from that position on two fronts: First the USD is the international reserve currency, and second the asset basis at the Fed is much stronger than the paper assets – a.k.a. toxic IOU paper – of the ECB’s collateral base.

Ode to assets that are no one else’s liabilities!