Have you seen him lately? He is still rolling that stone up to the hill. He is my good friend, Sisyphus. He was condemned to roll the stone up the hill and as he is approaching the summit, the rock will go down the plain again. So, as I am drafting this, I am wondering: is this a prelude or a requiem?

Sisyphus will come down the hill, and in his condemnation he feels that he is free. He is free in his torture. He is free in his passions. His scorn of the gods, his defiance of death, and his imagination breathes life into the symphony. As he comes down the hill, his face shines. It is called the hour of consciousness. You see, my good friend is a hero, because he knows who he is. He has an identity. He knows that he is stronger than the rock. He is sustained because he has not rejected his identity and his anchor. We are told that the story is tragic. It might be, but the reason is not what you think.

He is not sustained by the hope of success. His torture becomes his crown of fidelity that negates the gods and raises the rock.

As Sisyphus rolls the stone up the hill, he whispers: “The times they are a changing. Now, they celebrate paper assets. They feel that someone else’s liabilities are our own assets! However, in the ocean of paper that surrounds the financial markets (some five hundred trillion dollars and counting), the fat tail becomes what Thanksgiving is for turkeys. The turkey may be fed for weeks, months and even years. The week prior to Thanksgiving it is still expecting food, but guess what… its time has come.”

The financial press is full of articles regarding currency wars. So is this a prelude or a requiem? The central banks are in a competitive devaluation run that amounts to which one will devalue its currency faster. The reasoning is that by cheapening their currencies, they believe that their competitiveness will rise, and thus growth will take place. If that were true, Zimbabwe (please do not misunderstand me I have nothing against that particular country) would have been the paradise of exports and competitiveness. However, we all know that for the latter two to take place, the rule of law needs to be present, property to be respected, political and economic stability to have strong roots, an industrial base must exist, a middle class to be in formation and the comparative advantages to be cultivated (among other things). Growth is the outcome rather than the goal.

We have been on record that the crisis similar to the one that started in the summer of 2007 will have three phases: credit/stock/financial crisis whose epicenter was the US marks the first phase; which is followed by fiscal crisis whose epicenter was/is the EU; to be concluded (final phase) with what could become the mother of all crises i.e. the collapse of currencies and of fiat money.

Our strong belief in hard assets (ode to them as we have repeatedly said) is based on the belief that the global vessel of finance has been sailing into international waters without an anchor for close to 40 years now. It seems to us that the prelude of a requiem is being drafted nowadays. It may take some time, but the start can been seen where China is conducting business with Brazil, Russia, and Turkey in their respective currencies bypassing the dollar. It is also seen in the unprecedented quantitative easing of the Japanese central bank that has openly said that they may start buying securities including stocks! It may be seen in the statements of our own Fed regarding re-inflating the economy via quantitative easing part two (QE2). It may be seen in the regulatory measures taken by countries such as Brazil, Korea, Thailand, and others, in order to stop the appreciation of their currencies. It may be seen in the appreciation of currencies that have some hard-asset basis, such as the Australian, New Zealand and Canadian dollars.

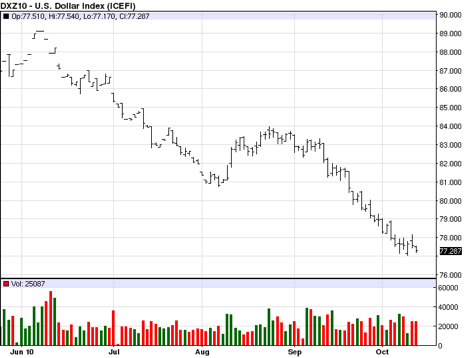

The US dollar index has been dropping steadily, as the following figures shows.

Calls keep coming in for a new currency pact that will help cure the global imbalances and restart growth on a new basis. The Managing Director of the Institute for International Finance (IIF) Mr. Charles Dallara, has been calling for an “international understanding”. The race to the bottom for currencies that has started reflects the spirit of “beggar thy neighbor , that may result in the new round of monetary disruptions (the housing market may be blamed again in the name of foreclosures), which also could lead to political turmoil. The currency volatility has been rising which has made the Nobel-winner Dr. Mundell (“the father of the Euro”) to claim “we have never been in this unstable position in the entire currency history of 3000 years”.

The appreciation of hard assets could be perceived as the mirror image of the lost faith in fiat currencies. The increased volatility will have significant consequences in world markets from exports, to imports, to production, to shipping, and from employment to advertising. When four trillion dollars in forex is traded every day, seeking speculative yields and returns, we know that something rotten is eating away the financial system. The US keeps the pressure up for China to revalue its currency. The world has been flooded with US paper and greenbacks, while the Fed is contemplating additional expansion of its balance sheet. This paper glut does not allow the economy to fly. The financial/currency instability we are observing (a.k.a. the prelude in the symphony) finds its historical precedent when the British abdicated their reserve currency leadership role i.e. when they refused (or proven unable) to roll up the rock again to the top of the hill in the late 1920s, with the result of a global depression. We saw that being partially repeated in the early 1970s with the dollar being debased from gold (the anchor of the global vessel). We all know what followed.

The US cannot and should not abdicate its currency leadership position. In the Giza pyramids the sphinx stands as the protector. The sphinx has four distinct parts: lion, cow, human, and eagle. The base of the pyramid is a rectangle with four corners. If a new international currency pact is needed, the US and the dollar should lead in stabilizing the other currencies via a stable relationship to an anchor (the latter to be determined). If the base is stable, the pyramid will stand.

Sisyphus is who he is because of his relationship to the rock/anchor. His identity and purpose of being does not allow him to jump on the bandwagon titled “the being of our nothingness” a.k.a. worthless paper assets.

Sisyphus then, decides to keep rolling the rock up the hill. He knows well that as he abdicates his role, a metamorphosis will take place, and he cannot be like Gregor (Kafka’s hero who experienced a metamorphosis), because Gregor turned out to be a cockroach. Sisyphus knows well that Gregor’s metamorphosis took place because he abdicated his role and abandoned his anchor.

Sisyphus is wise, and will turn to Homer who first told us his story of defiance. Homer points to Goya. Sisyphus full of curiosity asks Goya: “What is this that you are painting?”

“Oh, nothing” Goya replies. “It’s a painting of Saturn eating his kids.”

Homer also tells us that Agamemnon had behaved like Saturn for the sake of sailing to Troy. He sacrificed his daughter Iphigenia, deceived Achilles – who had been promised Iphigenia as his wife – and sailed to catastrophe. The knife that killed Iphigenia, which was made of the most precious metals and the deception of Achilles, had the stamp of his good friend, Odysseus. Agamemnon will be killed by his wife. Odysseus will wander the seas and he will have suitors after his property and his wife. But then, like Sisyphus he will find himself and his home. He will find who he was really meant to be and he will be happy that he is not the one who killed Homer so that his Odyssey could be told to future generations.

I am waiting for Sisyphus at the foot of that hill, proclaiming dum spiro spero while holding on to hard assets and singing sic transit gloria mundi…

A Sishyphonian Symphony: Currencies, Fiat Money, Hard Asssets, and the Puzzle of the Sphinx

Author : John E. Charalambakis

Date : October 14, 2010

Have you seen him lately? He is still rolling that stone up to the hill. He is my good friend, Sisyphus. He was condemned to roll the stone up the hill and as he is approaching the summit, the rock will go down the plain again. So, as I am drafting this, I am wondering: is this a prelude or a requiem?

Sisyphus will come down the hill, and in his condemnation he feels that he is free. He is free in his torture. He is free in his passions. His scorn of the gods, his defiance of death, and his imagination breathes life into the symphony. As he comes down the hill, his face shines. It is called the hour of consciousness. You see, my good friend is a hero, because he knows who he is. He has an identity. He knows that he is stronger than the rock. He is sustained because he has not rejected his identity and his anchor. We are told that the story is tragic. It might be, but the reason is not what you think.

He is not sustained by the hope of success. His torture becomes his crown of fidelity that negates the gods and raises the rock.

As Sisyphus rolls the stone up the hill, he whispers: “The times they are a changing. Now, they celebrate paper assets. They feel that someone else’s liabilities are our own assets! However, in the ocean of paper that surrounds the financial markets (some five hundred trillion dollars and counting), the fat tail becomes what Thanksgiving is for turkeys. The turkey may be fed for weeks, months and even years. The week prior to Thanksgiving it is still expecting food, but guess what… its time has come.”

The financial press is full of articles regarding currency wars. So is this a prelude or a requiem? The central banks are in a competitive devaluation run that amounts to which one will devalue its currency faster. The reasoning is that by cheapening their currencies, they believe that their competitiveness will rise, and thus growth will take place. If that were true, Zimbabwe (please do not misunderstand me I have nothing against that particular country) would have been the paradise of exports and competitiveness. However, we all know that for the latter two to take place, the rule of law needs to be present, property to be respected, political and economic stability to have strong roots, an industrial base must exist, a middle class to be in formation and the comparative advantages to be cultivated (among other things). Growth is the outcome rather than the goal.

We have been on record that the crisis similar to the one that started in the summer of 2007 will have three phases: credit/stock/financial crisis whose epicenter was the US marks the first phase; which is followed by fiscal crisis whose epicenter was/is the EU; to be concluded (final phase) with what could become the mother of all crises i.e. the collapse of currencies and of fiat money.

Our strong belief in hard assets (ode to them as we have repeatedly said) is based on the belief that the global vessel of finance has been sailing into international waters without an anchor for close to 40 years now. It seems to us that the prelude of a requiem is being drafted nowadays. It may take some time, but the start can been seen where China is conducting business with Brazil, Russia, and Turkey in their respective currencies bypassing the dollar. It is also seen in the unprecedented quantitative easing of the Japanese central bank that has openly said that they may start buying securities including stocks! It may be seen in the statements of our own Fed regarding re-inflating the economy via quantitative easing part two (QE2). It may be seen in the regulatory measures taken by countries such as Brazil, Korea, Thailand, and others, in order to stop the appreciation of their currencies. It may be seen in the appreciation of currencies that have some hard-asset basis, such as the Australian, New Zealand and Canadian dollars.

The US dollar index has been dropping steadily, as the following figures shows.

Calls keep coming in for a new currency pact that will help cure the global imbalances and restart growth on a new basis. The Managing Director of the Institute for International Finance (IIF) Mr. Charles Dallara, has been calling for an “international understanding”. The race to the bottom for currencies that has started reflects the spirit of “beggar thy neighbor , that may result in the new round of monetary disruptions (the housing market may be blamed again in the name of foreclosures), which also could lead to political turmoil. The currency volatility has been rising which has made the Nobel-winner Dr. Mundell (“the father of the Euro”) to claim “we have never been in this unstable position in the entire currency history of 3000 years”.

The appreciation of hard assets could be perceived as the mirror image of the lost faith in fiat currencies. The increased volatility will have significant consequences in world markets from exports, to imports, to production, to shipping, and from employment to advertising. When four trillion dollars in forex is traded every day, seeking speculative yields and returns, we know that something rotten is eating away the financial system. The US keeps the pressure up for China to revalue its currency. The world has been flooded with US paper and greenbacks, while the Fed is contemplating additional expansion of its balance sheet. This paper glut does not allow the economy to fly. The financial/currency instability we are observing (a.k.a. the prelude in the symphony) finds its historical precedent when the British abdicated their reserve currency leadership role i.e. when they refused (or proven unable) to roll up the rock again to the top of the hill in the late 1920s, with the result of a global depression. We saw that being partially repeated in the early 1970s with the dollar being debased from gold (the anchor of the global vessel). We all know what followed.

The US cannot and should not abdicate its currency leadership position. In the Giza pyramids the sphinx stands as the protector. The sphinx has four distinct parts: lion, cow, human, and eagle. The base of the pyramid is a rectangle with four corners. If a new international currency pact is needed, the US and the dollar should lead in stabilizing the other currencies via a stable relationship to an anchor (the latter to be determined). If the base is stable, the pyramid will stand.

Sisyphus is who he is because of his relationship to the rock/anchor. His identity and purpose of being does not allow him to jump on the bandwagon titled “the being of our nothingness” a.k.a. worthless paper assets.

Sisyphus then, decides to keep rolling the rock up the hill. He knows well that as he abdicates his role, a metamorphosis will take place, and he cannot be like Gregor (Kafka’s hero who experienced a metamorphosis), because Gregor turned out to be a cockroach. Sisyphus knows well that Gregor’s metamorphosis took place because he abdicated his role and abandoned his anchor.

Sisyphus is wise, and will turn to Homer who first told us his story of defiance. Homer points to Goya. Sisyphus full of curiosity asks Goya: “What is this that you are painting?”

“Oh, nothing” Goya replies. “It’s a painting of Saturn eating his kids.”

Homer also tells us that Agamemnon had behaved like Saturn for the sake of sailing to Troy. He sacrificed his daughter Iphigenia, deceived Achilles – who had been promised Iphigenia as his wife – and sailed to catastrophe. The knife that killed Iphigenia, which was made of the most precious metals and the deception of Achilles, had the stamp of his good friend, Odysseus. Agamemnon will be killed by his wife. Odysseus will wander the seas and he will have suitors after his property and his wife. But then, like Sisyphus he will find himself and his home. He will find who he was really meant to be and he will be happy that he is not the one who killed Homer so that his Odyssey could be told to future generations.

I am waiting for Sisyphus at the foot of that hill, proclaiming dum spiro spero while holding on to hard assets and singing sic transit gloria mundi…