We live in peculiar, maybe schizophrenic days. The drama that started unfolding in August 2007 pertained to Act I – known as the bursting of credit bubbles – that carry with them significant negative effects for equity and debt markets and in their own way they in turn, destroy capital (physical, financial, human, and institutional), paper wealth, and economic prospects.

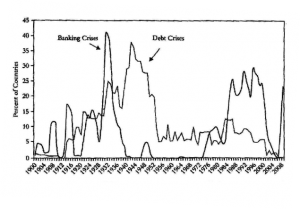

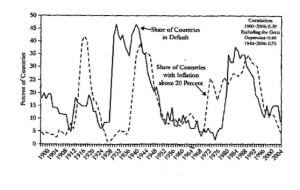

Act II of the drama, is known as the socialization of costs (while prior to Act I i.e. during the creation of the credit bubbles, the profits were privatized) where the fat cows eat the grass of the common field where all the cows are being fed a.k.a. the tragedy of the commons. The result is that some cows on the edges (read periphery of the EU) are starving and eventually die due to the fact that the large fat cows ate all the grass. Countries start bailing out beloved special groups through deficit explosion, hence the socialization of costs. The explosion of deficits and consequently of debts, do not allow all the cows to be saved because the assets are not there to support further credit creation for everyone. The result of this drama is that nations-cows are led to starvation via austerity programs which frequently lead to sovereign defaults as the following two graphs clearly show. The first graph shows that banking crisis (caused by overextension of credit) lead to debt cycles, which – as the second graph demonstrates-lead in turn to sovereign defaults.

Source: Reinhradt & Roggoff; NBER; Mauldin & Tepper

Source: Reinhradt & Roggoff; NBER; Mauldin & Tepper

However, the second graph above makes another clear implication. The two Acts are also followed by inflationary periods that destroy paper/fiat money. This is Act III in the unfolding drama, where all paper money loses value and ground against hard assets. In the incoming Act III all currencies will be devalued against precious metals and other hard assets that are capable of retaining their value in times of crises.

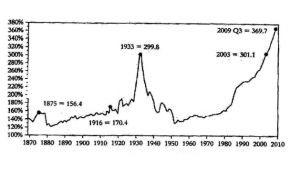

The following graph shows that when debt cycles reach their apotheosis, the recession that follows (with or without austerity) leads to a long period of instability where the economy stays down for an abnormally long period.

Source: BEA; Federal Reserve Bank

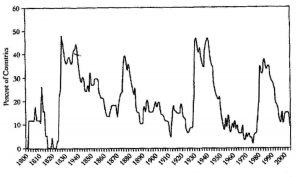

During this long period of instability the percentage of nations that default reaches high levels as the following graph demonstrates.

Source: Reinhardt & Rogoff

The new era that will dawn (besides the New Silk Road which may – we hope not – take a backstage until things clear) will be characterized by greater market volatility, frequent recessions, high and long-term unemployment, social and political instability, more deleveraging, corporate bankruptcies, sovereign defaults, and shaky prospects even for debt-free institutions given the contraction of credit and of consumption.

As I am drafting these lines, I am traveling overseas, where Portugal just a day ago announced her need for an IMF/EU bailout. People are interested mainly in three things: First, what the consequences of a bond haircut would be; second, what the effects of a potential sovereign default would be; and third, what is a potential way out (more on the latter in an upcoming commentary).

In a nutshell here is a brief synopsis of my reply (of course, there are many more things that someone could add):

- Liquidity will be sharply reduced. That would automatically shake up the nation that is proceeding with the haircut/default in terms of lower wages, benefits, revenues, profits, employment, investments, asset prices, and capital spending, among other things.

- The banking sector will be consolidated, while the debt/bond market will be dead for a few years (in the best case scenario).

- If a group of nations proceed within the same path, then the currency of the group will be shaken and maybe its very existence may be threaten.

- Unless a Deus ex machina appears where through his wooden crane can pronounce a divine end to the unfolding tragedy/drama, then no feasible solution is foreseeable. (We are of the opinion that such Deus ex machina exists, but this is not the issue in this commentary). Of course, in the long run everything returns to its equilibrium and problems are solved. The issue of course is not just that in the long run we are all dead, but most importantly that the end is here.

- Deficit spending may not work if the debt market is dead, unless the nation enjoys an exorbitant privilege of printing its own money and/or owing its debt in its sovereign currency.

- Social programs and pension plans will be discredited and their unfunded liabilities will remain paper claims of a betrayed generation.

- Political and social instability (especially for the thin cows) is an understatement.

- Deflationary pressures will prevail until the nation monetizes its debt. Such pressures will exacerbate the symptoms/pains described above. In other nations that choose to inflate away their debts via the printing machine, the pain may go away quicker.

- As small thin cows default, their debt is downgraded and hence the balance sheets of banks that belong to bigger cows takes a hit. They will in turn start selling the paper (bonds) of the fattest of all cows, and the pronouncement will be “Pigs (Portugal, Ireland, Greece, Spain) ‘r US”.

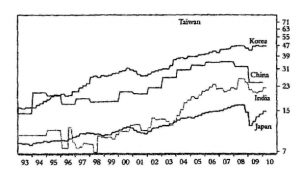

- Some nations will try to export their way out of debt via currency devaluations (beggar-thy- neighbor policies). Those that cannot do that (due to the fact that they may belong to a group such as the Eurogroup), may choose to return to their former sovereign currencies via a weekend-long suspension of the common currency where they devalue significantly (while the markets are closed over the weekend), knowing well that this very painful solution (for the sake of “restoring” export competitiveness) may inflict much more pain through debt explosion, corporate defaults, unemployment, and lower spending power. They simply try to comply with the economic recipe followed through the ages where growth comes through the export machine (see following graph that shows the exports as a percentage of local GDP).

Source: ECRI

Would it be too much, if we pronounce again, Ode to hard assets?

A Drama in Three Acts: From Credit Extension to the Tragedy of the Commons and the Trajectory of Paper Money

Author : John E. Charalambakis

Date : April 8, 2011

We live in peculiar, maybe schizophrenic days. The drama that started unfolding in August 2007 pertained to Act I – known as the bursting of credit bubbles – that carry with them significant negative effects for equity and debt markets and in their own way they in turn, destroy capital (physical, financial, human, and institutional), paper wealth, and economic prospects.

Act II of the drama, is known as the socialization of costs (while prior to Act I i.e. during the creation of the credit bubbles, the profits were privatized) where the fat cows eat the grass of the common field where all the cows are being fed a.k.a. the tragedy of the commons. The result is that some cows on the edges (read periphery of the EU) are starving and eventually die due to the fact that the large fat cows ate all the grass. Countries start bailing out beloved special groups through deficit explosion, hence the socialization of costs. The explosion of deficits and consequently of debts, do not allow all the cows to be saved because the assets are not there to support further credit creation for everyone. The result of this drama is that nations-cows are led to starvation via austerity programs which frequently lead to sovereign defaults as the following two graphs clearly show. The first graph shows that banking crisis (caused by overextension of credit) lead to debt cycles, which – as the second graph demonstrates-lead in turn to sovereign defaults.

Source: Reinhradt & Roggoff; NBER; Mauldin & Tepper

Source: Reinhradt & Roggoff; NBER; Mauldin & Tepper

However, the second graph above makes another clear implication. The two Acts are also followed by inflationary periods that destroy paper/fiat money. This is Act III in the unfolding drama, where all paper money loses value and ground against hard assets. In the incoming Act III all currencies will be devalued against precious metals and other hard assets that are capable of retaining their value in times of crises.

The following graph shows that when debt cycles reach their apotheosis, the recession that follows (with or without austerity) leads to a long period of instability where the economy stays down for an abnormally long period.

Source: BEA; Federal Reserve Bank

During this long period of instability the percentage of nations that default reaches high levels as the following graph demonstrates.

Source: Reinhardt & Rogoff

The new era that will dawn (besides the New Silk Road which may – we hope not – take a backstage until things clear) will be characterized by greater market volatility, frequent recessions, high and long-term unemployment, social and political instability, more deleveraging, corporate bankruptcies, sovereign defaults, and shaky prospects even for debt-free institutions given the contraction of credit and of consumption.

As I am drafting these lines, I am traveling overseas, where Portugal just a day ago announced her need for an IMF/EU bailout. People are interested mainly in three things: First, what the consequences of a bond haircut would be; second, what the effects of a potential sovereign default would be; and third, what is a potential way out (more on the latter in an upcoming commentary).

In a nutshell here is a brief synopsis of my reply (of course, there are many more things that someone could add):

Source: ECRI

Would it be too much, if we pronounce again, Ode to hard assets?