In the last couple of weeks a reality seems to be settling in the minds of over-optimistic investors. That reality says that it would not be so easy to enact legislation that will turn things around overnight. Moreover, investigations and questions about administration’s officials involvement with foreign entities infuse a sense of uncertainty that may unnerve the markets down the road and impose a cloud of apprehension.

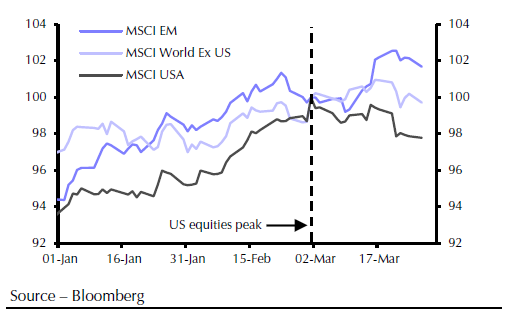

At the same time, emerging markets kept enjoying an upswing. Hence, while the US market took a pause in the month of March and ended up at a lower level than where it started, emerging market stocks kept moving higher, as the graph below shows.

The explanation for this divergence might be found in the fact that emerging markets stocks did not gain as much as US stocks since November, as well as due to the fact that global trade is turning. A number of economies experienced significant gains in their exports. Australia’s exports increased by close to 38%% in the course of the last several months. India’s exports gained 17% in the last 12 months. As the graph below shows a number of countries are enjoying this revitalization in global trade which is also due to higher growth expectations in developed markets such as the US and the EU.

When we look at the economic data for the developed markets we observe that output and economic activity are rising, consumption is on an upswing, unemployment declines, capital expenditures are increasing, while sentiment remains at a multi-year high. All of these indicators seem to signify that the rally still stands on solid ground for the time being.

However, the noise that is transmitted through populism, political uncertainty, and directionless leadership has started becoming a cacophony that could unsettle ephemeral expectations in a market that by some standards is overvalued, especially when we take into account the fundamental problems that the economies around the world are facing.

Therefore, as we look at developed markets we tend to favor more – relative speaking – markets that have greater upside (e.g. EU vs. US equities) while we also like trailing stops just in case that the cacophony starts shaping up as a requiem.

Global Market Resilience: Noise, Global Trade, and Policy Directives

Author : John E. Charalambakis

Date : April 4, 2017

In the last couple of weeks a reality seems to be settling in the minds of over-optimistic investors. That reality says that it would not be so easy to enact legislation that will turn things around overnight. Moreover, investigations and questions about administration’s officials involvement with foreign entities infuse a sense of uncertainty that may unnerve the markets down the road and impose a cloud of apprehension.

At the same time, emerging markets kept enjoying an upswing. Hence, while the US market took a pause in the month of March and ended up at a lower level than where it started, emerging market stocks kept moving higher, as the graph below shows.

The explanation for this divergence might be found in the fact that emerging markets stocks did not gain as much as US stocks since November, as well as due to the fact that global trade is turning. A number of economies experienced significant gains in their exports. Australia’s exports increased by close to 38%% in the course of the last several months. India’s exports gained 17% in the last 12 months. As the graph below shows a number of countries are enjoying this revitalization in global trade which is also due to higher growth expectations in developed markets such as the US and the EU.

When we look at the economic data for the developed markets we observe that output and economic activity are rising, consumption is on an upswing, unemployment declines, capital expenditures are increasing, while sentiment remains at a multi-year high. All of these indicators seem to signify that the rally still stands on solid ground for the time being.

However, the noise that is transmitted through populism, political uncertainty, and directionless leadership has started becoming a cacophony that could unsettle ephemeral expectations in a market that by some standards is overvalued, especially when we take into account the fundamental problems that the economies around the world are facing.

Therefore, as we look at developed markets we tend to favor more – relative speaking – markets that have greater upside (e.g. EU vs. US equities) while we also like trailing stops just in case that the cacophony starts shaping up as a requiem.